Since the legalization of sports betting in the United States, the industry has boomed, with a significant impact on both the economy and the professional sports landscape.

In 2024, sports betting continues to drive new streams of revenue for states, sports franchises, and betting operators.

In this this article we’ll explore the top five states benefiting the most from legalized sports betting In 2024.

As well as, who is leading in the revenue generation of sports betting, headed into the end of the first stretch of 2025.

The questions: how the legalization of sports betting is affecting team revenues, and the financial projections for the future of the industry.

How Sports Betting Has Affected Team Revenue

Legal sports betting has fundamentally transformed the way teams, leagues, and states approach revenue generation.

Teams in states where sports betting is legal are seeing increased profits, not only through direct sponsorships and partnerships with betting companies, but also from the fans betting on games.

Key financial impacts

- Sponsorship Deals: Teams are signing multi-million-dollar sponsorship deals with sportsbooks and online platforms (like DraftKings, FanDuel, etc.), creating a new revenue stream.

- Increased Fan Engagement: More fans are engaging with games through bets, driving higher attendance rates, merchandise sales, and overall fan engagement.

- Revenue Sharing: Leagues like the NBA and NFL now share a percentage of sports betting revenue with teams, leading to increased financial stability and growth.

Which States Benefit the Most from Sports Betting

While the legalization of sports betting has spurred profits in many states, it’s clear that not every state is benefiting equally.

States benefiting

- New Jersey: As one of the earliest adopters of legal sports betting, New Jersey remains a top contender, with sportsbooks generating billions in annual revenue.

- Pennsylvania: The state has also seen significant growth, with high betting volume in both online and retail sports books.

- Nevada: Despite competition, Nevada continues to be a major player in sports betting, with its long history of legal gambling and massive infrastructure.

States with challenges

- Illegal States: States like Texas, Florida, and Georgia still prohibit sports betting, limiting the revenue potential.

- Economic Barriers: Some states face difficulty in establishing profitable betting markets due to low engagement or infrastructure challenges (e.g., Montana, Wyoming).

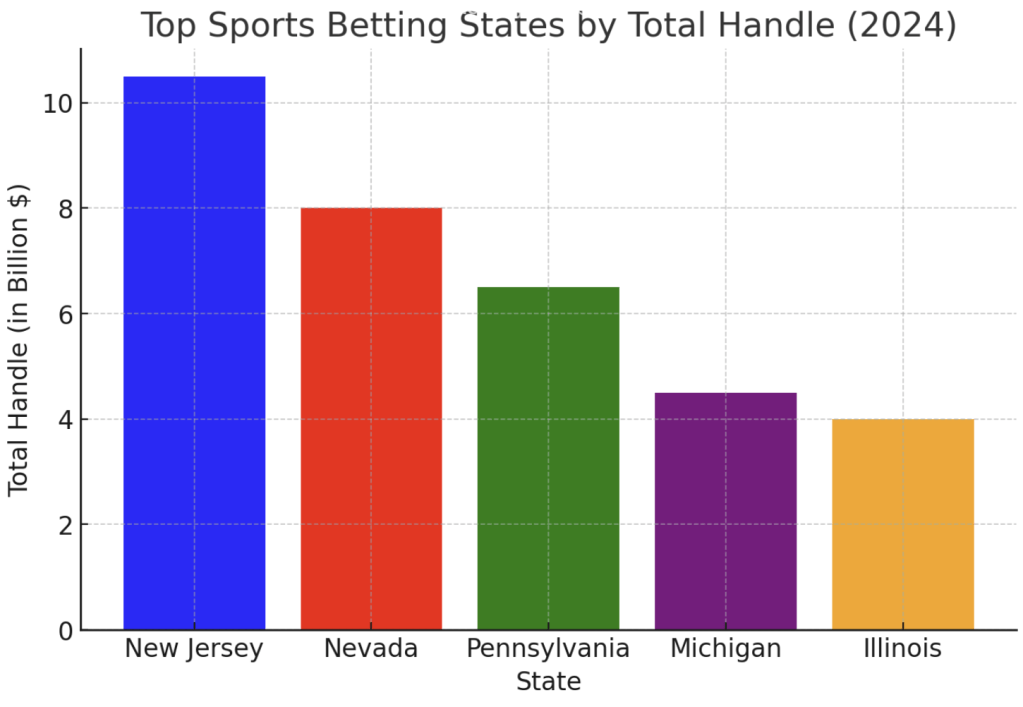

Top Betting States by Profit in 2024

Here’s a breakdown of the top states by betting profit in 2024, showcasing both total revenue and the major betting companies leading the charge:

1. New Jersey: $10.5 billion in sports betting handle.

2. Nevada: $8 billion in sports betting handle (primarily driven by sportsbooks like William Hill and Caesars).

3. Pennsylvania: $6.5 billion in sports betting handle, with FanDuel and DraftKings leading the market.

4. Michigan: $4.5 billion, largely driven by mobile sportsbooks.

5. Illinois: $4 billion in sports betting handle with substantial retail and online betting markets.

These states dominate due to a combination of regulatory support, large population bases, and the integration of online sportsbooks.

Top Betting Profit State

New Jersey has maintained its position as the top state for sports betting revenue in 2024, generating over $10 billion in total handle during the year. Leading the charge is FanDuel, which holds a substantial market share in the state, contributing to its dominance.

Why New Jersey tops the list

Early Legalization: As the first state to legalize sports betting outside Nevada, New Jersey set a precedent, leading to a strong market.

Online Sportsbooks: New Jersey benefits from a highly competitive online sportsbook market, increasing the number of bets placed from residents and out-of-state bettors.

High Population Density: With a large, sports-engaged population and proximity to major cities like New York, New Jersey has a unique advantage.

Why Full Legalization in All 50 States Isn’t Likely

While it’s unlikely that all 50 states will legalize sports betting in the near future, states like Washington continue to benefit from gambling revenue through other channels, like tribal casinos and horse racing.

- Tribal Casinos: Washington State benefits from its relationship with tribal casinos, which offer sports betting at their locations.

- Horse Racing: States like Washington also make money from horse racing and related events, filling the gap left by lack of full sports betting legalization.

States like these are able to generate betting-related revenues even without full-scale sports betting legalization.

Bigger vs. Smaller Betting Markets Comparison

When comparing betting revenues, there are two main factors: state size and frequency of betting activity.

- California: Despite being a huge market, California has not yet legalized sports betting, but it remains a significant potential revenue stream.

- Ohio: With a smaller population, Ohio sees more frequent bets per capita, leading to a steady stream of revenue.

- New York: Despite its size, New York’s heavy regulation slows down betting frequency, but large volumes still push its overall revenue higher.

Overall, frequency of betting and ease of access tend to outweigh market size in terms of total revenue.

2025 Sports Betting Industry Valuation

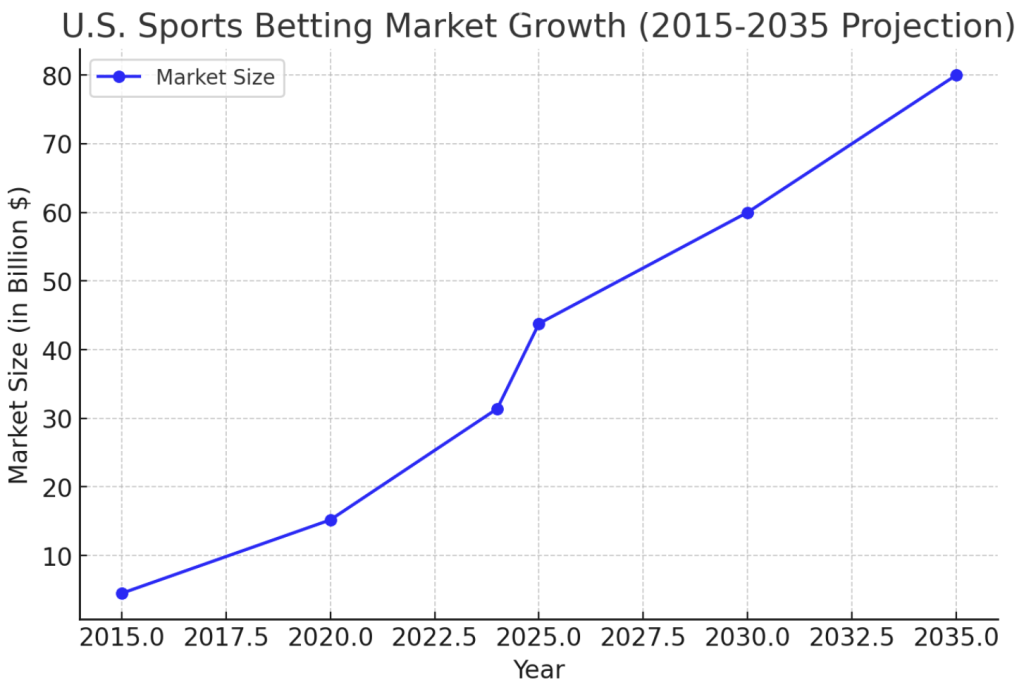

The sports betting market in the U.S. was valued at $31.4 billion in 2024 and is projected to reach $43.8 billion by 2025.

The industry continues to expand due to mobile platforms, widespread legalization, and increased public awareness of betting opportunities.

- Mobile Growth: Mobile betting apps like DraftKings and FanDuel are central to the market’s explosive growth.

- Retail Growth: Casinos, tracks, and sportsbooks are continuing to expand their retail operations, providing additional revenue streams.

Projections for the Sports Betting Market

Looking ahead, football remains the top bet, followed by basketball and baseball.

The increasing popularity of sports like eSports and soccer is expected to diversify the market.

With more platforms supporting various sports and bet types, the market will continue to flourish.

- Football: The NFL remains the primary sport for bets, making up a significant percentage of overall revenue.

- Basketball: The NBA follows closely, especially with high-profile playoff games.

- Baseball and Soccer: Baseball’s role is solidifying, and soccer is beginning to see increased attention in betting markets, particularly with global events like the World Cup.

Sports Betting Outlook by 2035

By 2035, the sports betting market is projected to surpass $80 billion annually, driven by mobile platforms, an increase in global sports betting, and the full legalization of sports betting.

- Mobile betting will be the primary driver, with more states legalized and more people engaging in betting via apps.

- Global Markets: As more countries legalize betting, the global sports betting market will expand, with a heavier focus on international sports.

In comparison, the market in 2015 was still in its infancy, with most states prohibiting sports betting.

The Evolving State of Sports Betting

As we look forward to 2025 and beyond, sports betting is poised for even more growth, with states like New Jersey, Nevada, and Pennsylvania leading the charge.

While not all states will legalize sports betting, the continued expansion through mobile apps, tribal casinos, and alternative forms of betting like horse racing ensures that the industry will remain a key revenue driver.

With market projections showing immense growth, sports betting will continue to reshape how both states and sports franchises approach their financial future.

Next Reads

- Why Esports is Turning to Betting Sponsorships

- Pistons’ Malik Beasley Accused by FBI of Sports Prop Betting

- 3 Sports Companies on the Rise in 2025

- NFLPA Boss Resigns After Misusing Union Funds

- What NCAA’s New Betting Rules Mean for Future Gambling Revenue

Credits

Written by: Aidan Anderson

Research and Analysis: Apostle Sports Media LLC

Sources: State revenue reports, sports betting market research, NBA CBA documents, Spotrac, ESPN, APSM Proprietary Analysis.

Market Research & Trends: Gaming industry reports, TicketMaster, SeatGeek, league websites, and sportsbook market data.

Sportsbook & Revenue Insights: Reports from FanDuel, DraftKings, BetMGM, Caesars, and other major betting operators.

Social Media Clips: Apostle Sports Media X (Formerly Twitter)

Featured Image: Google Gemini

Disclaimer: This article contains general financial information for educational purposes and does not constitute as professional advice.

“After the Lord Jesus had spoken to them, he was taken up into heaven and he sat at the right hand of God.”

– Mark 16:19