Streaming promised to be the upgrade: direct-to-consumer, wider reach, younger demographics, richer data, more flexibility than cable and bigger checks from licensing and media deals. Platforms pitched leagues on higher rights checks using the promise of digital scale and precision advertising.

The reality is more tangled.

The current model maximizes headline gross revenue figures for leagues and subscriber revenue for platforms, but shifts complexity, cost, and friction onto the consumer (fans).

That tension boosts short-term cash but risks weakening reach, advertiser scale, and long-tail fan engagement, the three pillars that actually support escalating rights bids.

Instead, the current distribution model is exposing a structural tension: leagues and platforms are maximizing headline rights revenue while shifting complexity and cost onto fans.

That tradeoff boosts short‑term cash but risks shrinking reach, increasing piracy, and eroding the long‑term ad and sponsorship value that underpins those big rights bids.

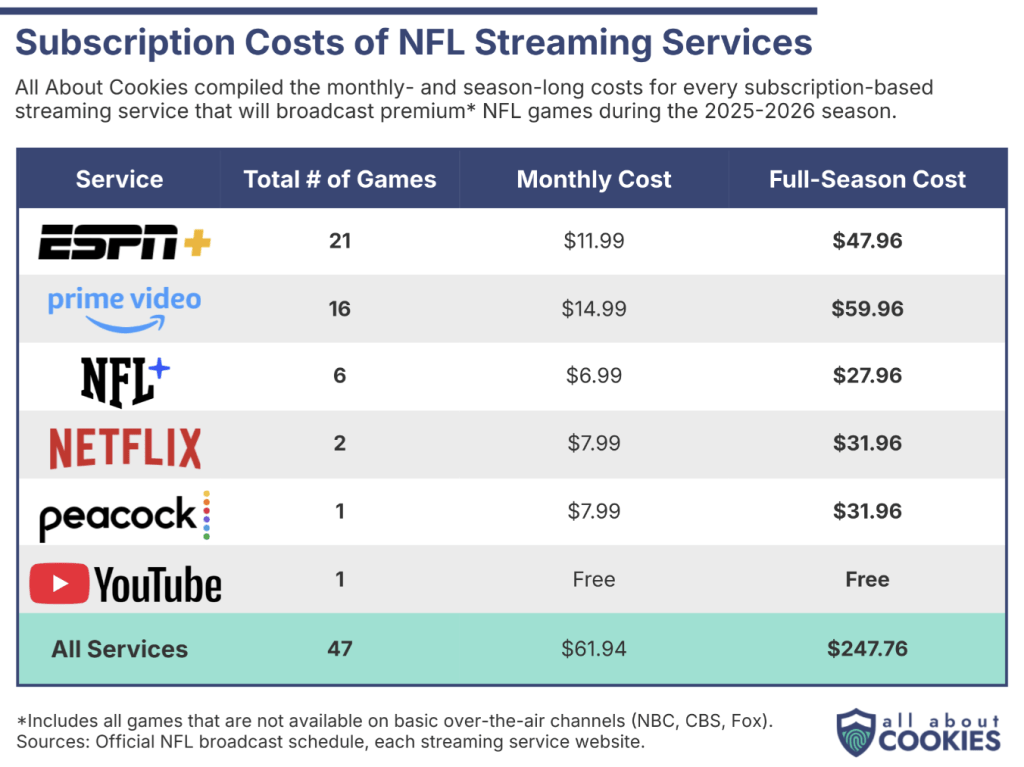

Fragmentation Math: What a Fan Pays

Fans must now pay a lot, considerably more than they would with traditional cable broadcasting.

To legally watch every NFL game in the U.S. this season, a viewer needs subscriptions to multiple services, national streamers, regional packages, paid cable bundles, and out‑of‑market “league passes”.

Depending on monthly vs seasonal billing and whether you buy playoff add-ons, total spending can range from selective viewing in the $300–$600/year range to full-coverage totals between $1,000–$1,600+.

Those price points force a binary choice: be a full fan or a selective fan.

Many choose selective.

That reduces total reach, compresses the long tail of viewers advertisers rely on, and weakens the per‑viewer ad value that justifies escalating rights fees.

But the actual problem isn’t the sticker price. It’s the binary segmentation it forces: Avid fans pay, casual fans filter and marginal fans and occasional viewers disappear.

Leagues historically monetized that long tail of casual viewers through ad impressions, broadcast reach, and brand exposure.

When the long tail disconnects, the ecosystem loses scale, and scale is what allows advertisers to justify premium CPMs.

So the paradox emerges: subscription dollars look strong on paper, but the contraction in reach quietly reduces the long-term value of rights.

Local‑market Access Disputes = Fans Get Locked Out

Streaming was supposed to simplify local rights, yet the transition made the contradictions more visible than what was initially promised.

National streamers are buying single-game exclusives while RSNs, broadcast affiliates, and legacy carriage deals still control local inventory.

The result lands on the consumer: a fan anywhere in the country can stream a game in seconds, yet when they go to turn on their local NFL game, they get “blacked out” due to local rules cable rules predating mass distribution on the internet.

That contradiction creates confusion and churn, and churn is a depreciating revenue model.

A model that goes against the very subscription models many streaming companies rely on and that are dependent on predictable retention curves and subscription growth.

Frustrated fans end up paying for redundant services they don’t want, hunt for workarounds like piracy, or may stop watching altogether.

Pay twice. Pirate. Or stop caring.

All three reduce measurable reach, engagement and advertiser confidence.

Are fans still paying?

Avid consumers will pay for premium access, and platforms take advantage of this knowledge to bid accordingly.

Streaming can grow key demographics, younger viewers and higher‑income households, in turn generating more revenue and creating more future revenue opportunity power.

The other side is that surveys show many consumers are near a subscription ceiling.

Casual viewers are price elastic. They churn first when costs spike or when friction increases.

Casual viewers are the marginal audience that drives advertiser scale and brand sponsorship value.

Without them, rights auctions look less rational over time.

The revenue tradeoff becomes:

- Subscription revenue = high-margin, predictable

- Ad revenue = scale-dependent, perception-sensitive: subscription dollars are predictable and attractive, but if subscriptions shrink the ad audience, total ecosystem value can fall even as headline rights fees rise.

Side Effects of Piracy and VPN Workarounds

Fragmentation incentivizes technical workarounds. Fans use VPNs, international passes, and illegal streaming sites to bypass local blocks or buy cheaper packages.

Where legal access is complex or expensive, piracy fills demand.

Piracy is invisible to advertisers and rights holders, so there is no way for companies to obtain analytics, receive proper advertisement payouts or profit from that illegal streams generated revenue in anyway.

This can eat into a pro-sports leagues’ licensing and media rights profits long-term, but is not the biggest slice of the streaming money pie, so sports leagues attempt to stop it, but aren’t majorly impacted by it.

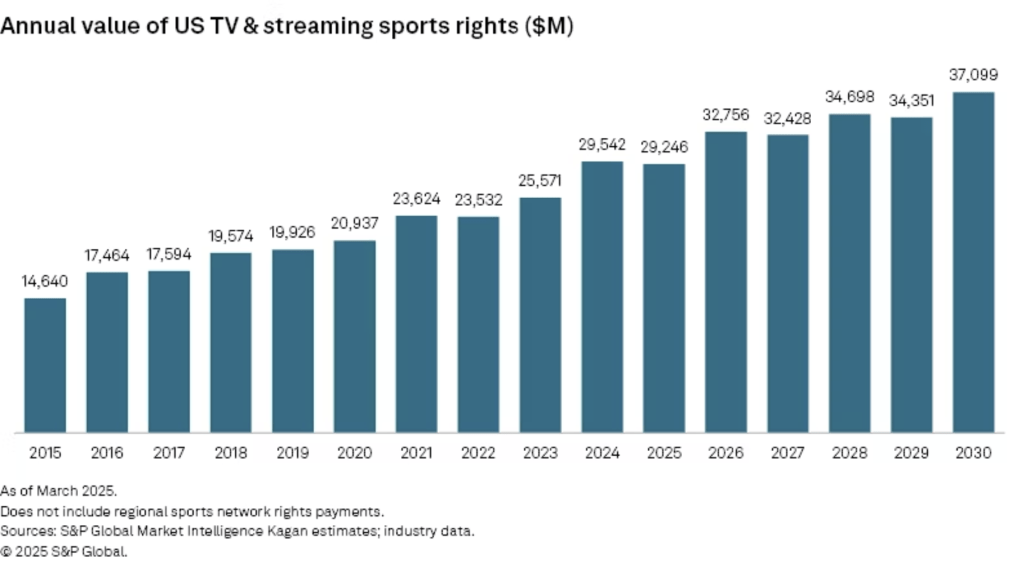

Is Streaming Backfiring on Revenue Models?

Short term: No.

Platforms are paying stockpile worthy sums of cash for the licensing and streaming of collegiate and pro-sports broadcasts and rights holders inside those same companies are cashing checks.

However, shifting costs and increasing friction to fans risks lower reach, higher churn, and more piracy, which can reduce ad rates and sponsorship value per viewer.

Medium term: Friction becomes measurable.

If leagues, broadcasters, and streamers re‑bundle access (single‑checkout season passes, clearer tiers, guaranteed access) and improve UX, the model can stabilize and preserve revenue gains.

Churn rates, blackout frustration, rising VPN usage, and shifting ad budgets will force re-bundling and re-pricing. The first platform to offer a clean, predictable, single-checkout all-games tier will test the market’s true ceiling.

Long term: Revenue growth depends on whether streaming evolves into a fan product or stays a revenue extraction mechanic.

The ecosystem withers if reach erodes faster than rights fees rise. Sustainability depends on treating distribution as a fan product, simplify pricing, reduce friction, and protect reach.

If fragmentation persists, the market could see slower rights inflation and weaker ad markets than projected, but if global viewership rises, revenue growth will likely continue its upward trend.

Specific Consequences to Watch

- Ad vs. subscription tradeoff: More subscriptions can mean fewer ad impressions due to premium/no-ad packages; advertisers pay for reach, not just premium demos.

- Rights inflation risk: If measured reach falls, bidders will rationalize future offers.

- Local revenue pressure: Teams and local sponsors suffer when in‑market viewership drops.

- PR backlash: Paywalled marquee games create negative headlines and consumer resentment, which damages long‑term goodwill.

How Leagues Could Fix Distribution

- Single‑checkout full‑season option: a clearly priced all‑games pass or tiered packages (local team, national package, all‑games) to reduce complexity.

- Guarantee in‑market access: eliminate the “your team is blacked out at home” problem by folding local rights into a controlled product.

- Flexible bundles: monthly, team‑season, and playoff add‑ons so casual fans can pay only for what they want.

- Anti‑piracy + de‑incentivize piracy: enforce piracy while removing the economic reasons to pirate.

- Ad+subs hybrid products: data‑driven ad packages that preserve advertiser reach without forcing consumers into six subscriptions.

- Platform UX & discoverability: make finding and starting a game a 10‑second experience on every device.

These moves preserve headline rights fees while protecting reach and long‑term ad value.

Streaming, As Promised?

Yes and no. Technically, yes.

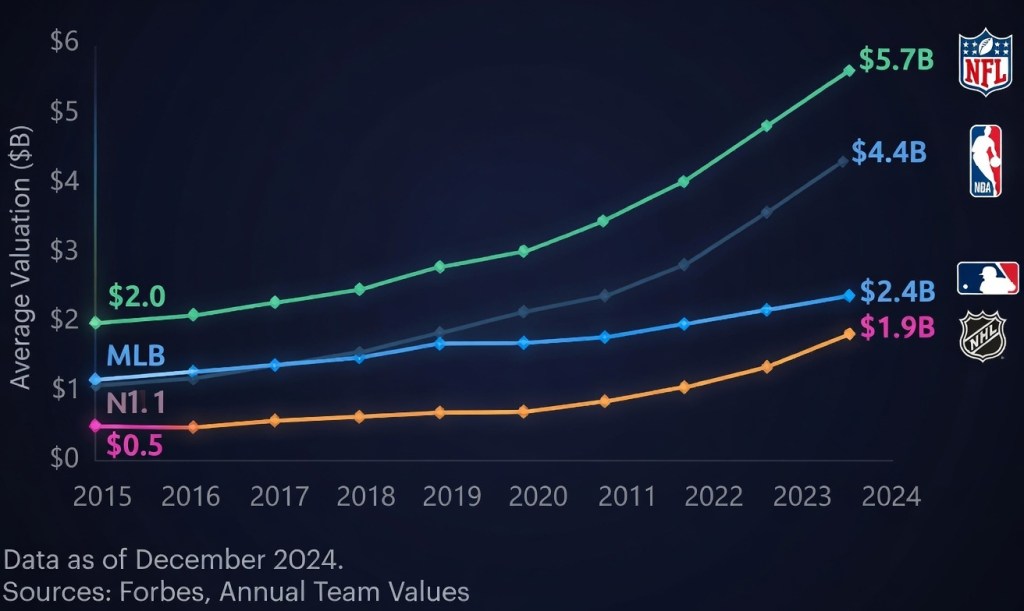

Revenue is up, younger demos are engaged, and digital rights auctions are still competitive.

Streaming partners are delivering growth in key demos and proving new distribution can scale. But the model is brittle if it continues to push cost and complexity onto fans.

Rights fees can’t defy gravity forever.

Long‑term value depends on reach, engagement, and trust, not just the size of the next rights check.

If distribution keeps making fans jump through hoops, measured reach will erode, piracy will grow, and rational bidders will eventually temper their offers.

When more fan friction enters the system, more advertisers demand “rational pricing”. Streaming can be a win for leagues and platforms, but only if distribution becomes a fan‑first product that balances subscription revenue with broad, measurable reach.

Streaming succeeds when leagues treat distribution as a fan product, not a toll booth.

Major League Valuations Over Past Decade

Enjoy Reading How Money Works In Sports?

The APSM $100 Million Pro Contract Report Includes:

- Contract structure analysis

- Federal and stat taxes, agent fees, and escrow modeling

- Sponsorships, endorsement and bonus impact scenarios

- Investment & wealth retention and long-term strategies

- Real-world case studies of player earnings vs take-home

Everything you need to understand how multi-million dollar contracts translate into actual wealth and how to avoid common financial pitfalls in pro sports. Buy the report today and see the truth hidden behind the curtain of money in sports.

Next Reads

- How Media Rights & Streaming Deals Influence Player Salaries

- Apollo’s $5 Billion Private Equity Fund Explained

- NBC’s $3 Billion Olympic Media Rights Deal Through 2036

- WWE SmackDown’s Global Distribution Deals and What They’re Worth

- DAZN’s $3.4 Billion Foxtel Acquisition Reshapes Sports Streaming

Credits

Written By: Aidan Anderson

Research & Analysis: Apostle Sports Media LLC

Sources: Forbes; TheWrap, Reuters, Morningstar/MarketWatch, VPN guides, APSM proprietary analysis

Featured Image: Public Domain / Grok Image Creation

Disclaimer: This article contains general financial information for educational purposes and does not constitute professional advice.

Hatred stirs up conflict,

but love covers over all wrongs.

– Proverbs 10:12