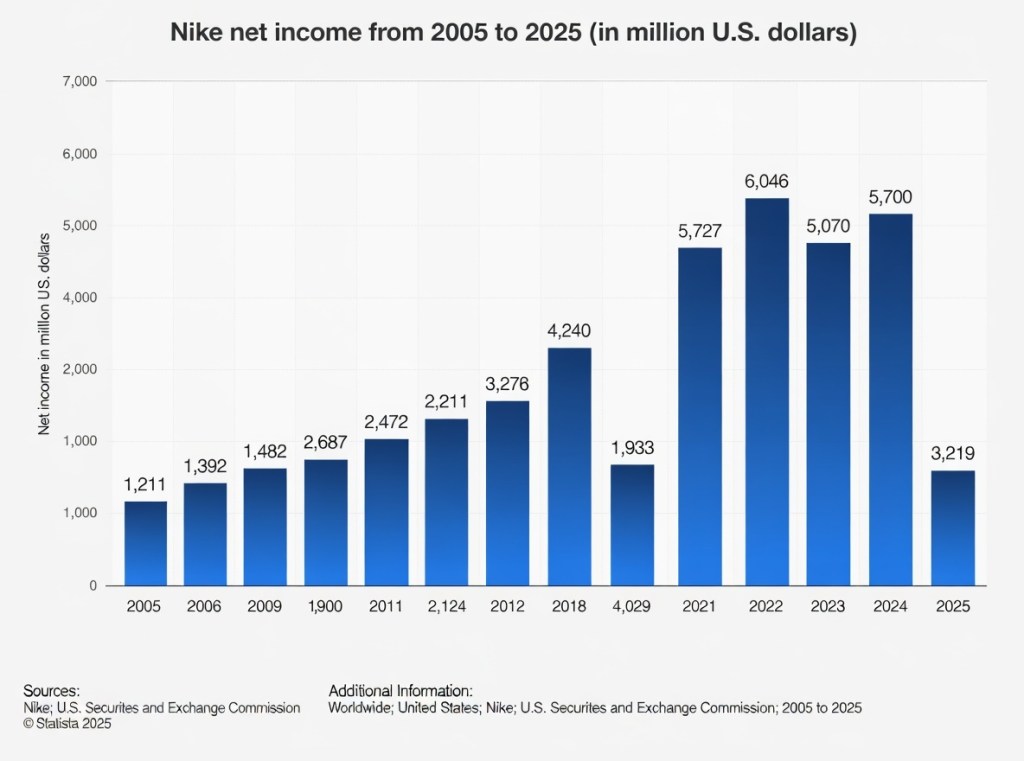

Nike has reported its lowest net income since 2020, attributing the downturn to the financial strain imposed by recent U.S. tariffs.

The company anticipates a ~$1 billion hit due to these tariffs, which has led to increased production costs and reduced margins.

In the fourth quarter of fiscal 2025, Nike’s revenue declined by 12% to $11.1 billion, marking its weakest quarterly earnings in over three years. This downturn is primarily attributed to the 10% import tax on goods from foreign countries, including a 60% tariff on footwear imported from China.

To mitigate these costs, Nike plans to reduce its reliance on Chinese manufacturing, currently accounting for 16% of U.S. footwear imports, aiming to decrease this to a high single-digit percentage by May 2026.

Nike is also planning to implement selective price increases in the U.S. market, evaluating costs and corporate reductions.

For a company that historically thrives on their name, scale, brand power (Just Do It), and margin efficiency, tariffs function less like a headline event and more like a structural tax on the business model.

Footwear operates in tight-margin bands, and when input costs rise quickly, the physics of global supply chains become impossible to ignore.

Tariffs → Costs → Margins

In fiscal Q4 2025, Nike posted $11.1 billion in revenue, a ~12% decline versus pre-tariff baselines near $12.6 billion. Gross margins compressed, and net income fell to post-2020 lows. The most direct trigger was the U.S. import tax regime: a 10% general tariff layered with category-specific surcharges, including up to 60% on Chinese-manufactured footwear.

Nike estimated the effective tariff hit around ~$1 billion for the fiscal year, a number that includes not only direct duties but secondary effects on freight, logistics, and landed manufacturing costs.

Businesses typically respond to cost shocks through three levers:

- Raise prices

- Re-engineer supply chains

- Reduce expenses (corporate + marketing + product)

Nike pursued a blend of all three.

Manufacturing Geography

A major underreported part of the tariff narrative is geographic concentration.

~16% of U.S. footwear imports in 2025 still originated from China, a number Nike intends to push to “high single digits” by mid-2026 through diversification into Vietnam, Indonesia, and near-shoring pilots in Mexico and Central America.

Why this matters:

- China remains the most efficient manufacturer at scale

- Vietnam is cost-competitive but capacity-limited

- Indonesia offers labor advantages but slower throughput

- Near-shoring reduces tariff exposure but raises labor and logistics costs

The trade-off is no longer where in the world is the cheapest labor.

It’s where is tariff-adjusted profitability the highest while also keeping wages low.

Pricing Power vs. Consumer Elasticity

Nike selectively raised U.S. footwear prices in 2025 to offset tariff drag.

Historically, Nike’s brand has given it unusual pricing power, but the 2024-2025 consumer cycle punished discretionary price hikes. Sneaker culture also shifted as resale markets normalized and hype-demand cooled.

Private-label athletic footwear and mid-tier competitors gained marginal share, which may seem tactically insignificant, but small shifts matter when the model depends on volume + margin leverage.

Endorsements Under Duress

One of the quieter corners of the financial story was endorsements.

Nike were the designer of the NFC West teams’ 2025 alternates, makes all of the University of Oregon football teams’ uniforms, and has done many other nationally known marketing tactics for the swoosh.

The Fortune 500 has always financed elite athlete partnerships and has sponsored many pro and collegiate sport leagues, using a hybrid branding P&L approach and tariffs forced a reprioritization of spend.

Lifetime-tier deals: LeBron James, Kevin Durant, Cristiano Ronaldo, Tiger Woods and Serena Williams remained untouched. These function as brand infrastructure, not marketing line items.

The endorsement ecosystem for Nike is financially downstream of corporate earnings. If Nike’s free cash flow remains pressured through 2026, emerging athletes may see:

- smaller guarantees

- delayed escalators

- country-specific FX-adjusted rates

- “equity + revenue share” style deals

The lifetime-tier athletes won’t lose money, the marginal athlete will.

The cuts and restructures showed up lower on the pyramid:

- more performance-based clauses

- shorter-term deals

- lower guaranteed cash pools

- category-based incentives instead of fixed rates and bonuses

In 2025, Nike reportedly allocated ~$600 million to top-tier legacy endorsement guarantees while compressing emerging athlete spend to roughly ~$80 million with structural changes favoring upside-based compensation.

That shift mirrors the way teams handle contracts in cap sports: secure foundational veterans, tailor incentives to upside prospects, and avoid bloated guarantees where uncertainty is highest.

Net Margin, Inventory & FX Reality Check

Margins fell almost ~$950 million year-over-year when combining tariff loading, softer demand elasticity, and less efficient turnover.

FX headwinds (USD vs. Asia) further pressured international profitability, another variable amplified by global manufacturing geography.

Nike as a Trade-Policy Company

For decades, Nike was analyzed through branding, consumer culture, and athlete influence. The 2025 transition reframed Nike as a global trade-policy company, where tariffs, supply chains, and geopolitics materially change earnings just as much as product cycles.

End-of-2025 scenario board:

- Best Case: diversified manufacturing + stable tariffs + FX normalization + China reopening → margin recovery

- Most Likely Case: slow unwind of Chinese production + selective price raises + modest consumer bounce → steady earnings

- Risk Case: prolonged tariff regime + anti-China legislative cycles + margin fatigue → endorsement compression + cost cuts

Nike’s durability depends on how well it can convert tariff shock into long-term supply chain resilience rather than short-term margin erosion. That adaptation phase is now underway.

Next Reads

- Revenue

- The Streaming Problem in Sports

- Dick’s Sporting Goods Acquires Foot Locker

- DAZN’s $3.4 Billion Foxtel Acquisition Reshapes Sports Streaming

- What NCAA’s New Betting Rules Mean for Future Gambling Revenue

Credits

Written By: Aidan Anderson

Research & Analysis: Apostle Sports Media LLC

Sources: Nike Investor Relations, stock charts, The Guardian, Business Insider, MarketBeat, Hypebeast, APSM Proprietary Analysis

Featured Image: Public Domain / Grok Image Creation

Disclaimer: This article contains general financial information for

I instruct you in the way of wisdom

and lead you along straight paths.

– Proverbs 4:11