A business expense is a cost incurred in the process of earning income.

For athletes, business expenses exist because athletic careers are not jobs in the traditional sense, rather they are income-producing operations.

Training, travel, equipment, brand development, management, and professional services are not lifestyle choices when they directly support income generation.

When properly structured and documented, business expenses reduce taxable income, not revenue, lowering federal, state, and jock tax exposure legally.

The key distinction is purpose: If an expense exists because income exists, it may qualify as a business expense.

How Business Expenses Apply in Different Leagues

🎓NCAA / NIL Athletes

For NIL athletes, business expenses are the moment income stops behaving like allowance money and starts behaving like enterprise income. These expenses exist because NIL income exists, not because of lifestyle preference.

This is where young athletes either learn structure early or accidentally build bad habits that follow them into professional careers.

Use Cases

- Travel for NIL appearances and events

- Branding, content creation, and media costs

- Training tied to NIL income production

- Professional services (legal, accounting)

Example

A NIL athlete earns $140,000 and spends $22,000 on travel, content production, brand photography, and accounting services.

Those costs are business expenses because they directly support NIL income, reducing taxable income to $118,000. For NIL athletes, business expenses are often the first lesson in treating income like a business instead of a paycheck.

🏈NFL

NFL business expenses scale fast.

What starts as training costs quickly becomes a full operating ecosystem around performance, health, branding, and income protection.

At this level, expenses are not optional, they are the infrastructure that keeps revenue flowing and careers intact.

Use Cases

- Personal trainers and performance staff

- Nutrition, recovery, and body maintenance

- Business management and marketing costs

- Endorsement-related travel

Example

An NFL player earns $6.2 million and spends $480,000 annually on trainers, recovery staff, brand operations, and endorsement travel.

Those expenses reduce taxable income before federal and state taxes are applied.

At this level, poor expense tracking doesn’t just waste money, it creates unnecessary tax exposure.

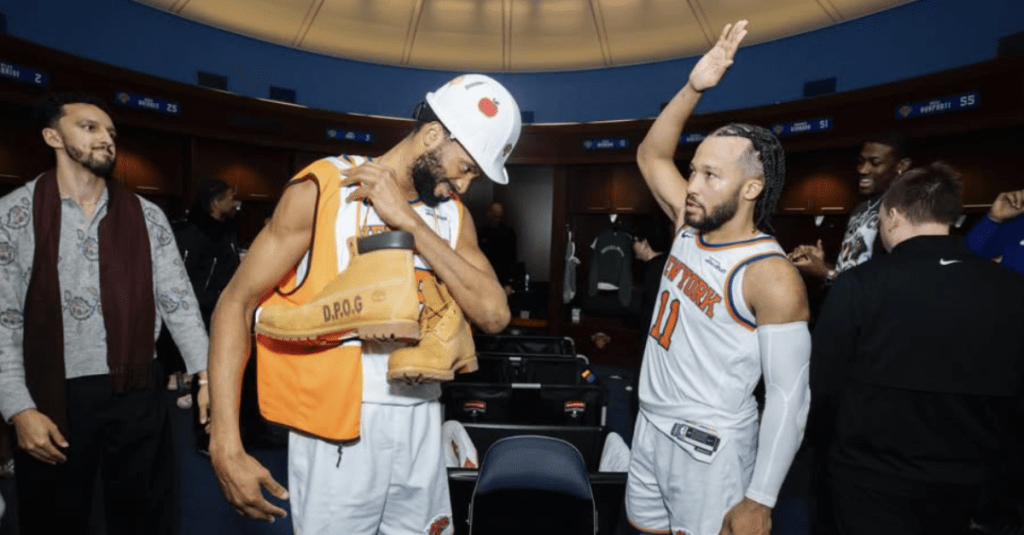

🏀NBA

MLB careers are long, mobile, and seasonally intense.

Business expenses often span multiple states, months, and income sources, increasing complexity around classification and documentation.

Without structure, small mistakes compound quietly over time.

Use Cases

- Media production and brand teams

- Business use of vehicles and offices

- Endorsement-related travel

- Personal staff tied to income generation

Example

An NBA player operates a brand company that produces content and campaigns.

Studio rentals, editors, marketing consultants, and travel for sponsorship work qualify as business expenses because they directly generate income.

For NBA players, expenses are often less about survival and more about scaling a personal brand.

⚾MLB

Use Cases

- Long-season travel for endorsements

- Training and recovery across states

- Business housing allocations

- Professional advisory fees

Example

An MLB player signs multiple offseason endorsement deals requiring travel.

Flights, lodging, and appearance-related costs qualify as business expenses when properly documented.

With long seasons and frequent relocation, MLB players face higher exposure to misclassification errors.

🏒NHL

For NHL athletes, business expenses frequently include compliance itself. Cross-border income, residency rules, and treaty navigation make professional services a necessary operating cost.

Here, expenses are not about optimization, they’re about staying compliant.

Use Cases

- Cross-border tax compliance costs

- Business-related housing expenses

- Endorsement operations

- Legal and accounting services

Example

An NHL player pays U.S. and Canadian tax professionals to manage filings and treaty compliance.

Those advisory fees are business expenses because they directly support income management.

For international athletes, compliance itself becomes an operating cost.

⚽MLS / International Soccer

International soccer careers introduce relocation, regulatory, and branding friction.

Business expenses often bridge the gap between global income and local compliance. These costs aren’t inefficiencies, they’re the price of operating across borders.

Use Cases

- Relocation-related business costs

- Agent and representation fees

- Brand activation and media services

- Translation and legal support

Example

An international player joining MLS incurs branding, legal, and media expenses tied to endorsements.

These costs may qualify as business expenses when structured correctly under U.S. tax rules. Global careers require local compliance.

🥊Combat Sports

In combat sports, expenses often arrive before income is earned.

Training camps, coaching, and promotion must be paid regardless of fight outcome.

This makes expense planning just as important as fight preparation.

Use Cases

- Training camps and gym fees

- Coaches and sparring partners

- Promotion and marketing costs

- Medical and recovery services

Example

A fighter spends $90,000 on a training camp, coaching staff, and promotional content for a fight.

These expenses offset fight income, reducing taxable exposure during peak earning periods.

In combat sports, expenses often arrive before income, making planning critical.

⛳Golf / Individual Sports

Individual athletes operate without team infrastructure.

Business expenses directly replace what organizations would otherwise provide. Every dollar spent is an investment in performance, longevity, or visibility.

Use Cases

- Coaching and performance analytics

- Tournament-related travel

- Equipment used for competition

- Sponsorship-related branding

Example

A golfer deducts coaching fees, travel to sponsor events, and competition equipment as business expenses tied to professional income.

For individual athletes, nearly everything revolves around performance efficiency.

🏎️Racing / NASCAR / F1

Racing expenses scale with exposure.

As visibility increases, so do branding, media, and performance costs required to stay competitive and relevant.

In racing, expenses protect earning power as much as performance.

Use Cases

- Simulator training and performance tech

- Media and sponsorship operations

- Brand-related travel

- Professional services

Example

A driver incurs costs for simulator training, sponsor media days, and brand management.

These expenses reduce taxable income tied to racing and endorsement revenue.

High exposure = high operating costs.

Why Business Expenses Matter

Business expenses matter because they determine how much income actually survives the system.

- Reduce taxable income legally

- Improve cash-flow efficiency

- Protect against tax overpayment

- Separate business from lifestyle spending

But misuse is expensive.

Personal expenses disguised as business expenses invite audits, penalties, and back taxes.

The line between legal deductions and tax trouble is business purpose, consistency, and documentation.

They don’t reduce revenue.

They reduce taxable income.

When handled correctly, business expenses improve efficiency, preserve cash flow, and prevent athletes from overpaying taxes they never owed in the first place. When handled poorly, they blur the line between business and lifestyle, and that line is exactly where audits live.

Smart expense strategy isn’t aggressive. It’s organized, intentional, and documented.

Business expenses don’t make athletes rich, they stop athletes from leaking money they already earned.

Related Terms

Next Reads

- Greg Norman’s $500 Million Golf Business Empire

- Apollo’s $5 Billion Private Equity Fund Explained

- Dick’s Sporting Goods Acquires Foot Locker

- 3 Sports Companies on the Rise in 2025

- DAZN’s $3.4 Billion Foxtel Acquisition Reshapes Sports Streaming

Jesus answered,

“I am the way and the truth and the life. No one comes to the Father except through me.”

– John 14:6