Puka Nacua and the Los Angles Rams defeated the Carolina Panthers in the Wildcard round of the 2026 NFL postseason 34-31, moving on to the divisional matchup.

Fans of the Rams see the win as the breakout rookie story of young sensation Puka Nacua and the MVP caliber play of QB Matthew Stafford that is fueling a Rams playoff run.

Finance people see something different: a 5th-round NFL rookie deal and a young-star navigating the most expensive housing market in America while optimizing liquidity, taxes, and career uncertainty.

At 24 years old, Nacua is at the start of his NFL earnings arc.

The league pays on a delayed curve, rookie deals lock players into artificially low compensation before extensions explode their income.

That means the most important financial skill in years 1–3 isn’t spending, it’s survival: how do you minimize burn, retain liquidity, and keep optionality open long enough to reach the payday window?

For Rams rising star Puka Nacua, the answer appears to be renting.

The Contract That Defines the Housing Decision

Nacua signed a four-year, $4,053,184 rookie contract with the Los Angeles Rams after being selected 177th overall (5th round) at the 2023 NFL Draft. From that ~$4 million, just $213,184 guaranteed.

Prorated over four seasons, the average cash compensation is roughly $1.013 million per year.

But, NFL players don’t keep that headline figure:

- Agent fees: ~3%

- Federal taxes (top marginal brackets): ~38% effective on NFL income

- California income tax (marginal 12.3%, ~9% effective blended)

- FICA: ~1.45%

- Workers comp + standard player dues

- Jock tax allocation on away games

After adjustment, a player in Nacua’s bracket retains roughly 44–48% of his gross earnings depending on travel schedule and deductions.

Using a midpoint, his $1.013 million average salary becomes ~$472,000/year in take-home pay.

That’s also before lifestyle, training, and operational expenses.

NFL athletes spend on things normal workers don’t: private physical therapy, offseason training, supplementation, nutrition, recovery, and appearance-based expenses that matter for brand and opportunity.

Modest athletes might still burn $85,000–$150,000/year to stay elite.

Add the brutally high cost of living in Los Angeles, California and the retention number compresses further. Early-career athletes don’t build wealth. They buy time until the extension window.

Why Renting Beats Buying in Los Angeles

Los Angeles real estate is one of the least forgiving buy scenarios in the country for wage income earners, let alone rookies.

Median home values in LA County ended 2024 at approximately $936,000, according to Zillow data, while desirable player neighborhoods (Manhattan Beach, Palisades, Hermosa, Encino/Studio City corridor, Westside) easily exit the $2–7+ million range.

Ownership carries real costs:

- Property taxes: ~1.25% in LA County → $25,000–$87,500/year

- Insurance: elevated for wildfire + coastal risk

- Maintenance: 1–2% of property value annually → $20,000–$100,000/year

- Capex shocks: high, unpredictable, non-optional

- Transaction frictions: ~6% sell-side fees + opportunity cost

Most rookie earners don’t want to lock six figures into carrying costs on an asset they may only occupy for 24–48 months.

NFL careers are transient. Teams cut, trade, or flip rosters rapidly.

Geography has no loyalty and renting shifts the risk. It’s operational expense, not capital allocation.

A reasonable athlete rental in the LA luxury tier ranges $9,000–$22,000/month, depending on neighborhood.

If Nacua rents conservatively near the lower half of that band, his annual housing cost sits roughly $108,000–$144,000.

Painful, but predictable.

No large down payment. No capex. No liquidity drag. No asset exposure if the Rams change direction or his contract timeline shifts.

For a player sitting above breakeven but below the extension window, predictability is wealth preservation.

Career Uncertainty Is an Economic Variable

Buying a house makes sense when three things align:

- Earnings certainty (multi-year extension + guarantees)

- Geographic certainty (staying in one city for 5+ years)

- Liquidity surplus (cash available beyond safety + investing buffer)

Nacua is in the zone before those variables mature.

NFL data shows the average career lasts 3.3 years, but receivers who secure second contracts can jump total earnings anywhere from 8x–20x their rookie cash.

That risk; reward curve favors keeping capital uncommitted and flexible.

When Nacua signs his second contract, even something “moderately” front-loaded in the $20-$24 million AAV, plus a signing bonus and a large portion of the contract being guaranteed compared to his current rookie deal, the entire housing math flips.

Suddenly buying is not a lifestyle decision, it becomes a wealth-holding decision with tax benefits and inflation-protected equity.

California Taxes + Jock Taxes Compress Margin

California stacks athlete taxes harder than almost any jurisdiction:

- High-income brackets

- High housing costs

- High operational costs

- High sales tax on consumption

On top of that, NFL players face jock tax apportionment, income taxed based on where games are played.

A Rams season allocates a significant slice back to California, increasing tax drag relative to Texas/Florida franchises where zero-state income tax boosts take-home by 9–12% on the same contract.

This is a hidden wealth gap across the league. The same $4 million rookie deal produces very different retention in Dallas, Miami, Jacksonville, Houston, Tampa, Tennessee, or Vegas than it does in Los Angeles.

Renting is a rational hedge against a punitive jurisdiction.

Inflation, Real Estate Cycles & Timeline

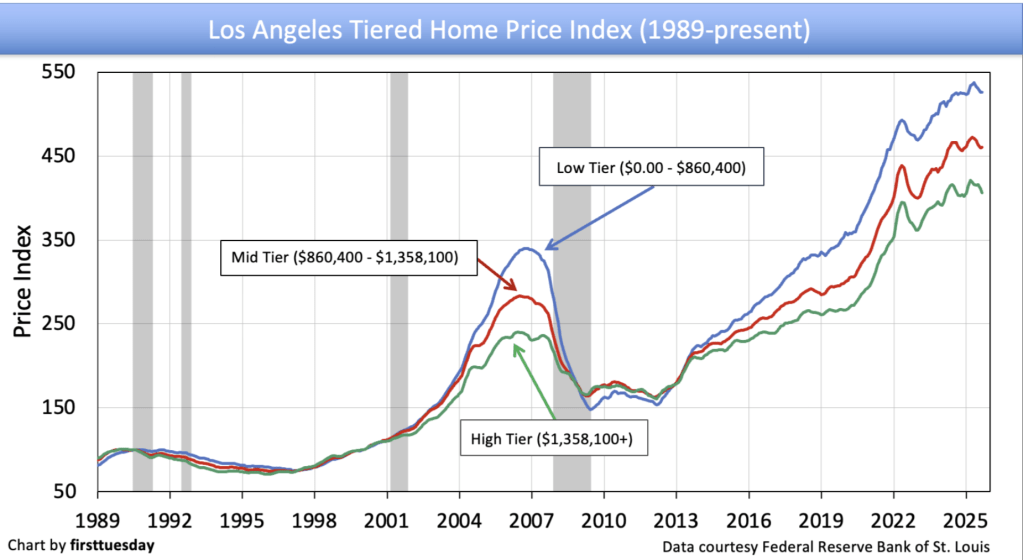

Real estate economics punish short timelines. The US housing market from 2020–2024 experienced double-digit inflation in luxury submarkets, driven by supply constraints, rate compression, and capital migration.

2024–2025 saw higher rates, lower transaction velocity, and price stickiness. Properties in LA’s upper-tier still sell, but the friction is real.

For a player who might switch teams in 18 months, that friction is expensive. Renting allows athletes to participate in high-COL ecosystems without incurring illiquid exposure.

The Playoff Premium

The Rams’ playoff surge changes the financial narrative. Playoffs extend media exposure, endorsement leverage, brand development, and future negotiation posture.

A deep run can accelerate the valuation curve of a skill-player more than an extra year of regular-season production. For Nacua, the timing aligns perfectly with his positioning for a potential extension in 2026. When that expectedly massive extension lands, the renting calculus flips almost overnight.

Athletes typically buy post extension, not prior. Cashflow is the real story.

Future Net Worth Arc

Right now, Nacua’s wealth arc looks like:

- Phase I: Survival & Liquidity

- Phase II: Optionality & Exposure

- Phase III: Negotiation & Valuation

- Phase IV: Allocation & Real Estate

- Phase V: Compounding, Reserving

Most athletes never reach Phase IV.

They make money → spend money → retire without capital.

Players who rent early, delay, and allocate capital later tend to outperform in net worth retention.

It’s counterintuitive, but restraint compounds more than bravado in finance.

APSM’s Take

Puka renting in Los Angeles isn’t a lifestyle choice, it’s a strategic one.

It preserves liquidity, protects downside, manages tax exposure, and keeps his balance sheet aligned with the extension window.

Athletes aren’t just performers anymore. They’re financial entities navigating geography, federal and state tax codes, housing cycles, labor contracts, union agreements, and uncertain career lengths.

Nacua plays football on Sundays.

His wealth is played Monday to Saturday. Stories like this aren’t gossip. They’re literacy.

The playoffs are the classroom.

Enjoy Reading How Money Works In Sports?

The APSM $100 Million Pro Contract Report Includes:

- Contract structure analysis

- Federal and stat taxes, agent fees, and escrow modeling

- Sponsorships, endorsement and bonus impact scenarios

- Investment & wealth retention and long-term strategies

- Real-world case studies of player earnings vs take-home

Everything you need to understand how multi-million dollar contracts translate into actual wealth and how to avoid common financial pitfalls in pro sports. Buy the report today and see the truth hidden behind the curtain of money in sports.

Next Reads

- What is a Contract Extension

- How NFL Signing Bonuses are Structured

- How the NFL Franchise Tag Works Financially

- Mercedes-Benz Stadium Financial Highlight

- Inside Tyrese Haliburton’s $3.2 Million Indianapolis Mansion

Credits

Written By: Aidan Anderson

Research & Analysis: Apostle Sports Media LLC

Sources: Sportrac, ESPN, LA Times, LA Housing Market Analysis, APSM Proprietary Analysis

Featured Image: Public Domain / Wiki Commons

Disclaimer: Financial information for educational purposes only. Not professional financial advice.

Since you are my rock and my fortress,

for the sake of your name lead and guide me.

– Psalm 31:3