Gross income refers to the total amount of money earned in any calendar year by an athlete (or any individual) before taxes and deductions. It includes all revenue streams, such as:

In sports finance, gross income is the starting number in every contract or net worth breakdown.

It’s the big number fans see in headlines, but not what athletes actually take home.

How Athletes Gross Income In Different Leagues

🎓NCAA / NIL Athletes

Gross income for college athletes doesn’t come from direct salaries, rather from NIL opportunities.

NIL deals create an equivalent:

all money that a student-athlete earns through endorsements, sponsorships, appearance fees, and social media promotions counts toward their “gross income” before taxes or agent fees.

This is the starting point for parents and student-athletes to begin evaluating financial opportunity, marketing power, and overall earning potential for players while they eligible to play in the NCAA.

Use Cases

- Athletes sign multiple NIL deals based on personal brand and performance.

- Transfers or breakout seasons often increase total NIL earnings.

- Schools and programs can highlight athletes’ earnings potential to attract recruits.

Example

Arch Manning signs with a national sportswear company such as Dick’s Sporting Goods for ~$500k for his endorsement of the company after their acquisition of Foot Locker.

His earnings and management fees for this singular deal are going to exceed ~$200K in a calendar year, representing how a collegiate athlete can earn gross income from NIL.

🏈NFL

How it’s used

Gross income is the total contract value before taxes are deducted, agent fees, and other proration strategies.

Use cases

- Used by sports media to inflate the perception of a deal

- Teams highlight it for PR, even though player take-home is often 50-60% of the actual reported number, due to taxes, agent fees, personal health maintenance, staff and any other mandatory expenses an athlete has.

- Players often have base salaries + signing bonuses + incentives wrapped into their contract yearly gross totals.

Example

Josh Allen’s 6-year, $258 million extension is the gross income value.

His net income, after taxes and fees, is estimated around ~$120 million.

🏀NBA

How it’s used

NBA deals are often fully guaranteed, so gross income often matches guaranteed money, minus escrow.

Use cases

- Every reported NBA extension headline uses gross income.

- Bonus clauses (All-Star, MVP) also added into gross projections.

- Escrow and union deductions lower the actual take-home.

Example

Jaylen Brown’s $304 million supermax contract with the Boston Celtics in 2025.

supermax contract = gross.

His actual take-home may be closer to the $160-180 million range after taxes and fees.

While this number is still generational wealth, it is not anywhere near the number that is reported by teams and the media to fans.

⚾MLB

How it’s used

MLB gross income includes salary, signing bonus, and deferred payments.

Use cases

- Deferred payments often distort the “real-time” net.

- Some players make less annually but stack value over time.

- Union dues and agent fees reduce net from gross.

Example

Shohei Ohtani’s 10-year, $700 million deal sounds massive, but $680 million is deferred for over a decade from the initial signing.

His gross from the massive deal is technically ~$700 million, but his net income is a different story.

This is also a trick that the Dodgers ownership is known to use on their books. Which is the reason it possible for them to sign big name free agents and retain some of the biggest stars in baseball for long periods of time.

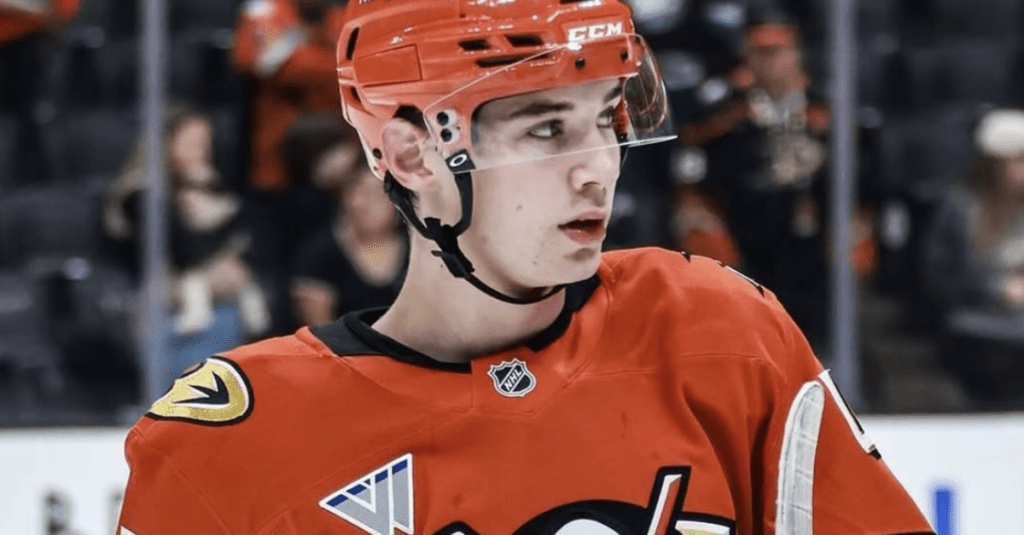

🏒NHL

How it’s used

NHL gross income is usually a combo of base + signing bonuses.

Use cases

- Heavy signing bonuses front-load gross income.

- Lockout-proofing makes up a chunk of “guaranteed” earnings.

- Agent fees + Canadian tax exposure take big chunks from gross.

Example

Connor McDavid’s $100 million deal was his gross.

Between Alberta tax rates, agent fees, and currency differences, his net is significantly less.

⚽MLS / International Soccer

Gross income in MLS and international soccer includes base salary, signing bonuses, performance incentives, and sponsorship deals.

Unlike U.S. leagues with escrow or salary caps, gross income in soccer is often publicly reported as the headline number, though net income can differ significantly after taxes, agent fees, and bonuses.

Use Cases

- Clubs structure contracts to include performance-based bonuses to maximize player motivation.

- Players leverage club contracts plus sponsorships to negotiate higher total earnings.

- Transfer negotiations often factor in projected gross income for the remainder of a player’s contract.

MLS Example

An MLS Designated Player earns a $1.2 million base salary, plus $300,000 in goal bonuses and $250,000 in sponsorships, giving him a gross income of ~$1.75 million.

International Soccer Example

Kylian Mbappé earns ~€15 million base salary at Real Madrid, plus a massive €150 million signing bonus and ~€5-€10 million in sponsorships.

His total gross income for the year will be ~€50-€60 million, though his net take-home after taxes and agent fees make his pocket cash/liquid assets access significantly lower.

🥊Combat Sports

How it’s used

Gross income here =

fight purse + bonuses + PPV points + sponsorships/endorsements

Use cases

- Fighters may get $500K “on paper” but earn $3+ million after bonuses.

- Gross includes locker room bonuses and discretionary money.

- No union, so no escrow, just direct taxes and team costs.

Example

Jon Jones might headline at $500K base purse, but end up actually grossing $2.5 million with PPV share, bonuses, and sponsor kick-ins.

Unlike with league sports like the NBA and NFL, top performing fighters can earn much more than the number media outlets report.

⛳Individual Sports

(Golf / Tennis)

How it’s used

Gross income in golf and tennis = tournament winnings + appearance fees + sponsorships + licensing deals.

The new LIV Golf circuit does include contracts for the athletes, but this is a new “league” and not as big as the PGA Tour or Masters.

Use cases

- PGA prize money is considered gross income.

- LIV Golf deals use massive upfronts that inflate reported gross.

- Endorsements can double/triple gross annually.

Example

Rory McIlroy’s on-course earnings are estimated to be ~$8 million, but his total gross income with Nike and TaylorMade = $40+ million.

Golf and Tennis are similar to the UFC and combat sports, where top performers can make significantly more money than what is reported.

This is because they do not sign standard contracts, like in major leagues where endorsements and sponsors are usually included.

🏎️Racing / NASCAR / Formula 1

How it’s used

Gross for racers =

salary + podium bonuses + sponsor payouts + licensing

Use cases

- Top drivers like Verstappen or Hamilton have base deals + earn millions in additional bonuses on top of their base salaries.

- Gross includes endorsements from luxury brands, gear companies.

Example

Lewis Hamilton earns a base of $55 million. With Mercedes, Tommy Hilfiger, and IWC sponsorships, gross income clears $70-80 million annually.

Why Gross Income Matters

Gross income is the headline number, but it doesn’t tell the full story. The real magic happens after that number is announced: In major leagues, taxes, agent fees, escrow, fines, jock tax, and union dues all shrink gross into net.

Wealth building depends not just on what athletes earn, but what they actually pocket and how they invest towards their post career futures.

Gross income is how fans see a contract, but net income is how a player survives 20 years post-retirement.

Gross income tells the story.

Net income tells the truth.

🔗Related Terms

🔗Next Reads

- How Media Rights & Streaming Deals Influence Player Salaries

- Paolo Banchero’s $239 Million Contract Extension

- T.J. Watt’s 3-Year, $123 Million Contract Extension

- Highest-Paid MLB Players of 2025

- Top Earning NASCAR Driver of 2025

“Wealth gained hastily will dwindle,

but whoever gathers little by little

will increase it.”

— Proverbs 13:11