Jock tax is an additional and unique income tax levied by states on athletes who earn money while playing games or competing in another state, regardless of their residency or where the state in which their organization resides.

It ensures states receive revenue from high-earning non-resident athletes passing through their jurisdiction.

Jock tax applies in addition to federal and state residency taxes, making it a critical consideration for multi-state or traveling athletes.

How Jock Tax Applies in Different Leagues

🎓NCAA / NIL Athletes

For NIL athletes, jock tax introduces many players to multi-state taxation for the first time.

As NIL income expands beyond campus and state lines, understanding where income is earned becomes just as important as how much is earned.

Use Cases

- Out-of-state competitions/games

- NIL-related appearances in other states than their university

Example

An NCAA athlete travels for a bowl game and earns NIL income during the trip. That state may levy a jock tax on those earnings.

🏈NFL

Jock tax is a material expense for NFL players due to weekly travel and high salaries.

Even players living in no-income-tax states remain exposed to jock tax through away games, bonuses, and performance-based pay.

Use Cases

- Away games

- Performance bonuses abroad

- Residency planning

Example

An NFL player lives in Texas (no state income tax) but plays 8 away games in California. California taxes the income earned for those games under its jock tax rules.

🏀NBA

NBA players face some of the most aggressive jock tax exposure because of frequent travel and games in high-tax states.

Allocation of salary, bonuses, and event income requires careful tracking to avoid overpayment or audit risk.

Use Cases

- Road games in high-tax states

- Bonus income allocation

- Tax planning for endorsements and events

Example

An NBA player residing in Florida plays multiple games in New York.

New York applies jock tax to the portion of salary earned there.

⚾MLB

With long seasons and extensive travel, MLB players often file tax returns in numerous states each year.

Jock tax can meaningfully reduce net income if not properly planned for through withholding and residency strategy.

Use Cases

- Multi-state season schedule

- Tax withholding

- State-specific reporting requirements

Example

An MLB pitcher earns $2 million in a season but owes additional taxes to states where away games were played. In MLB, this can mean losing an additional ~4-13% of any/all earnings that a player earns across all states that they played in during the season and postseason if needed.

For Instance, Justin Verlander plays 110+ games in the state of California, but plays 10 games in Washington, 20 in New York, and the remaining in Arkansas. The hall of fame pitcher will have to pay income tax and jock tax in the 3 other states that are not California where Verlander lives.

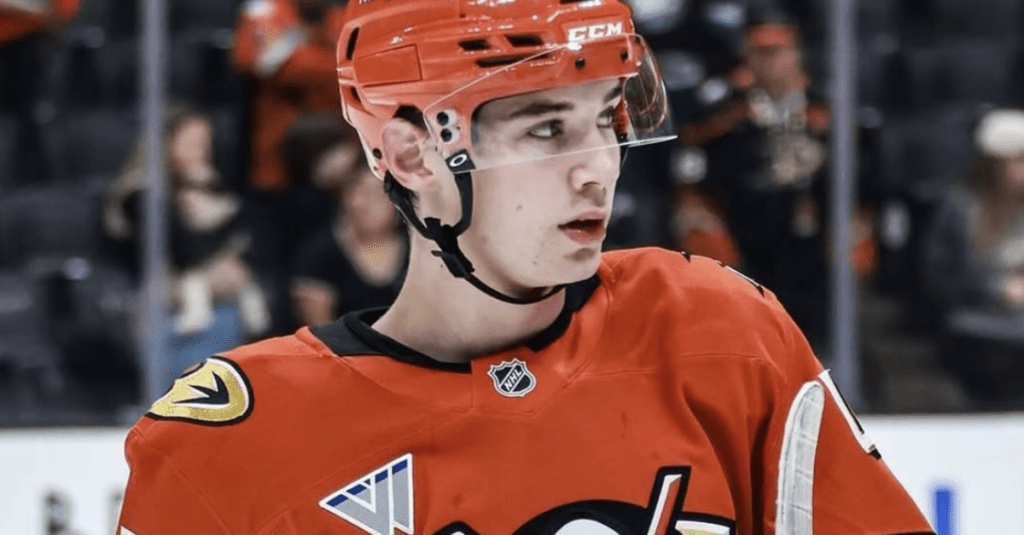

🏒NHL

NHL players face added complexity due to cross-border taxation.

Jock tax exposure may involve both U.S. states and Canadian provinces, requiring coordination across currencies, treaties, and dual tax systems.

Use Cases

- Cross-border teams (U.S./Canada)

- Away game taxation

- Currency adjustments

Example

An NHL player residing in New Jersey plays games in Canada.

Canadian provinces may impose a jock tax on income earned in those games.

⚽MLS / International Soccer

For soccer players, jock tax applies across domestic leagues and international competitions.

Residency status, treaty protections, and match location all influence how income is allocated and taxed.

Use Cases

- Domestic away matches

- International matches with taxing treaties

- Multi-state income reporting

Example

A U.S.-based soccer player playing away games in multiple states must pay jock tax where applicable.

🥊Combat Sports

In combat sports income is often concentrated in a single event and location, meaning that tax filing is often much easier than in other pro leagues where athletes earn income from multiple revenue streams.

Jock tax applies directly to fight purses and event-based earnings, making location selection and contract structure financially significant.

Use Cases

- Fight purses in states other than residence

- Sponsorship payouts tied to events

Example

A fighter earning $500,000 for a match in Nevada but living in Texas owes jock tax to Nevada on that income.

⛳Golf / Individual Sports

Individual-sport athletes frequently earn income across many jurisdictions.

Tournament winnings and appearance fees are taxed where events occur, requiring disciplined tracking to avoid surprise tax liabilities.

Use Cases

- Tournament winnings in multiple states

- Appearance fees for events

- Travel-heavy schedules

Example

A golfer earning prize money in California while living in Florida pays jock tax on tournament winnings.

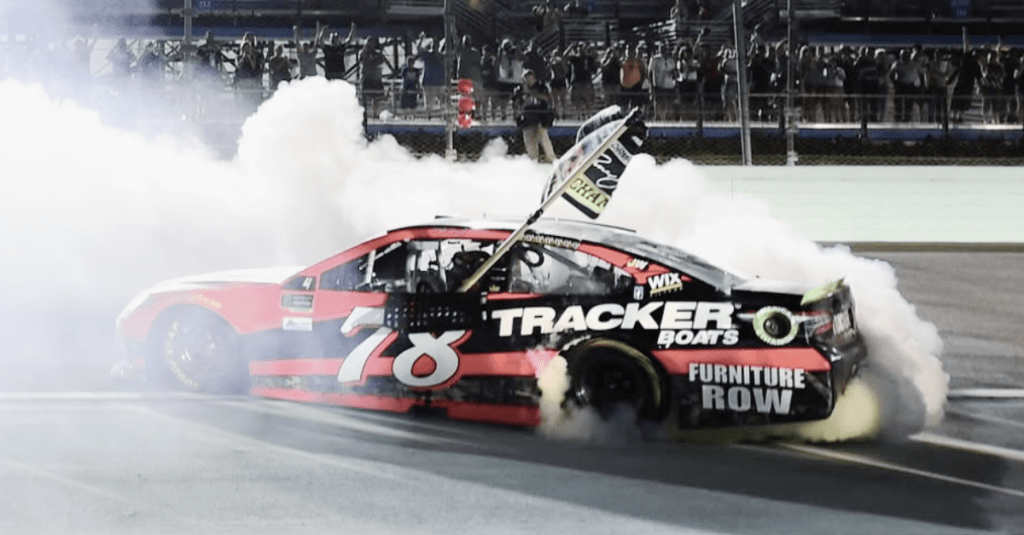

🏎️Racing / NASCAR / F1

Racing athletes earn income tied to specific venues, races, and sponsor activations.

Jock tax applies based on where events take place, even for drivers living in tax-friendly states or countries.

Use Cases

- Prize money earned in different states or countries

- Sponsorship-related event earnings

- Multi-venue taxation

Example

A driver earns $1 million for a race in Indiana but lives in a no-income-tax state. Indiana applies jock tax on the race earnings.

Why Jock Tax Matters

- Ensures athletes plan for multi-state tax liabilities

- Often overlooked by high-income earners

- Can significantly impact net income for traveling athletes

- Affects contract negotiations and lifestyle planning

Related Terms

Next Reads

- Why NHL Players Flock to Florida Teams: Taxes & Take-Home Pay

- Tyrann Mathieu’s Net Worth After Retirement

- Hulk Hogan Career Earnings & WWE Legacy

- Juan Soto Signs the Biggest Contract in MLB History

- T.J. Watt’s 3-Year, $123 Million Contract Extension

The Lord detests lying lips, but he delights in people who are trustworthy.

– Proverbs 12:22