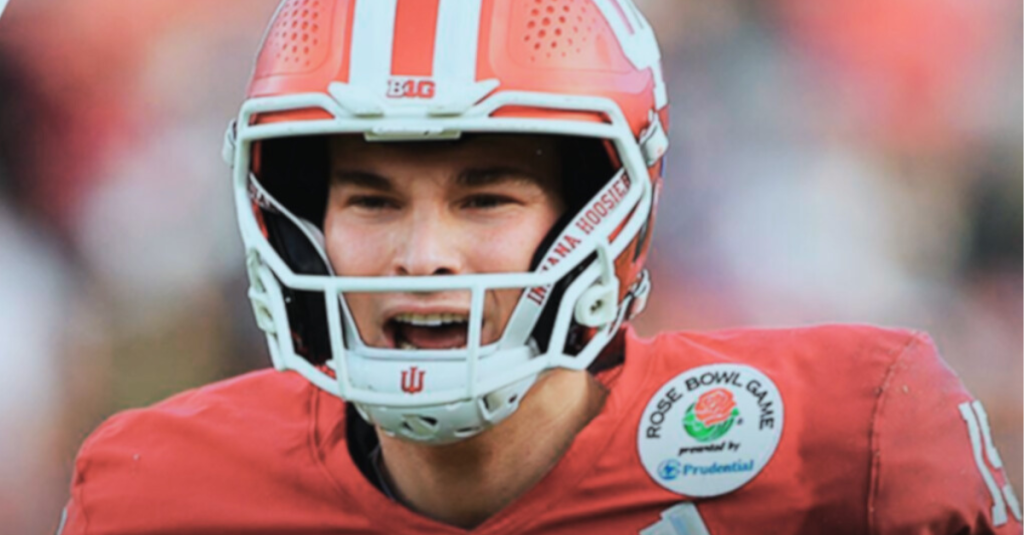

“I’m not thinking about the next game, I’m going to drink a beer”, said Indiana Hoosiers football head coach Curt Cignetti, after beating the Oregon Ducks 56-22 to win the 2026 College Football Playoff semi-final.

The Chick‑fil‑A Peach Bowl victory by Indiana punches their ticket to the national championship game, where they will take on Miami U to decide who the best team in college football is for the new year, 2026.

It is also marks the Hoosiers chance to win their first football national title in school history.

This game wasn’t just a shocking blowout for a CFP semifinal, (compared to the Miami vs Ole Miss thriller), it’s one of the most substantial single betting events on the college football calendar.

As Oregon and Indiana competed for their ticket to take on the Miami Canes in the 2026 national championship, billions in sports betting handle was moving through U.S. sportsbooks and global markets, driving massive economic activity long before the opening kickoff.

Understanding the financial weight attached to the betting revenue generated by the Peach Bowl requires viewing the event as more than a college football game.

The 2026 CFP Peach Bowl semi-final held at Mercedes-Benz Stadium in Atlanta, Georgia is a leverage point in a massive ecosystem, powered by sports wagering and fan engagement.

The CFP semifinal doesn’t just rake in revenue from tickets, sponsorships, endorsements, and media/streaming rights, sportsbooks are collecting big money on top of that, adding another layer to the game’s economic impact.

Sports Betting Landscape in the U.S.

In recent years, sports betting has grown explosively across the United States following widespread legalization.

Total U.S. betting statistics show tremendous year‑over‑year increases: In 2025, the total sports betting handle, the amount wagered reached roughly $113.9 billion, with gross revenue around $11 billion industry‑wide.

These numbers include all sports, but college football bowl games and the CFP playoffs are among the most actively bet events due to high viewer interest, wide spread availability across apps, and significant incentives offered by sportsbooks for new users.

What Betting Revenue Looks Like In the CFP

Unlike professional leagues where regular weekly betting revenue is widely reported, individual college bowl betting data (like the Peach Bowl handle) is not publicly disclosed in real time by regulators or sportsbooks. However, we can still estimate based on overall market activity, relative spread interest, and peak betting season dynamics.

College Football CFP Betting Trends

- Major bowl games have seasonal spikes in wagers, and bonuses/promotions drive peak engagement ahead of kickoff.

- Promos like “bet $5 get $200” and profit boosts attract new and casual bettors, increasing handle volume significantly.

- Peach Bowl odds are widely circulated, with sportsbooks pricing spreads and money lines that reflect national betting interest.

While exact Peach Bowl betting figures remain private, financial analysts estimate that semi‑final CFP bowls routinely generate tens of millions in total handle on single games, and gross revenue for sportsbooks in the low tens of millions as well, depending on outcome and hold rate.

These estimates come from extrapolating national handle percentages during CFP weeks and annual/monthly betting data.

How Betting Revenue Actually Works

To understand the economic impact, it helps to define the different terms:

Betting Handle

This is the total amount of money wagered on an event across all legal sportsbooks.

For context, in 2025, the overall monthly sports betting handle exceeded $15 billion in December alone, a month that includes many bowl games and playoff events.

This number suggests that individual marquee bowl games like the Peach Bowl command a disproportionately higher share of total handle value, due to concentrated betting interest.

Gross Gaming Revenue (GGR)

This is the amount sportsbooks keep after payouts, often called “hold.”

Across most U.S. states, typical hold percentages range from ~8%–10%.

So if bettors wager, for example, $100 million specifically on the Peach Bowl across all sportsbooks, the industry might retain $8–10 million in gross revenue.

Taxes & State Revenue

A portion of sportsbook revenue is taxed by states, contributing to public coffers. Tax rates vary by jurisdiction, some states like Kentucky see over 10% of revenue taxed, while others (e.g., Iowa) generate millions in tax revenue on smaller handles.

Economic Impact Beyond the Handle

Betting revenue isn’t the only financial effect of Peach Bowl wagering.

Increased Engagement = Higher Media Value

Networks broadcast the Peach Bowl to tens of millions of viewers, big audiences tend to correlate with peak betting activity, which increases ad value and sponsorship premiums around sportsbook ads.

Tourism & Local Spending

The cumulative economic impact of Peach Bowl events historically has contributed tens of millions to the Atlanta economy annually, including direct and indirect spending.

This includes spending by fans traveling for the game and by those participating in associated bowl week events, but it also indirectly boosts betting handle as those fans engage with sportsbooks on their mobile devices or at event venues.

Promotional Revenue

Sportsbooks push promotional credits and bonuses (bet refunds, boosted odds, etc.) to attract players specifically for major events like the Peach Bowl. These promos drive incremental revenue and can skew handle figures upward compared to normal weekly wagering.

Estimated Total Betting Revenue Impact for the 2026 CFP Peach Bowl

Although exact betting numbers aren’t yet public, a reasonable financial projection, grounded in broader betting trends and seasonal data looks like this:

- Total Betting Handle (Est.): Tens of millions (across legal sportsbooks)

- Gross Revenue to Sportsbooks (GGR): Low‑to‑mid single‑digit millions

- State Taxes & Fees: Hundreds of thousands to several million depending on jurisdiction

- Indirect Economic Impact: Tied to viewership, tourism, and promotional spending

The Peach Bowl sits at the intersection of three major revenue drivers: broadcast consumption, tourism spending, and sports betting activity, each adding to the aggregate economic value of the event.

APSM Takeaway

The Peach Bowl’s financial footprint goes far beyond the gridiron.

While individual betting revenue numbers aren’t released publicly, the broader U.S. sports wagering market shows that one of the most bet college football games of the year generates significant handle and gross revenue for sportsbooks.

It also supports state taxes and enhances tourism economics.

Everything in the modern sports ecosystem, from media rights to betting activity, compounds the value of events like the Peach Bowl.

Making this shocking demonstration of how good the Indiana Hoosiers are becoming a new force in the NIL and NCAA era, building them into a multi‑layered economic machine.

Now there’s just two teams left. Let us know on X who you think will win the national championship.

Thank you for reading.

Next Reads

- What NCAA’s New Betting Rules Mean for Future Gambling

- How Much the 2026 CFP Fiesta Bowl Generated in Revenue: Miami vs Ole Miss

- Lane Kiffin Could Earn $1 Million Off Ole Miss’s CFP Run After Leaving for LSU: Inside the Head Coach Postseason Bonus Structure

- College Football Has Entered Its Contract Era: The Financial Fallout of the Demond Williams Jr. Case

- Top 5 Sports Betting States in 2025

Written By: Aidan Anderson

Research & Analysis: Apostle Sports Media LLC

Sources: Sports betting handle & revenue data, Sports betting site comparisons, Peach Bowl economic impact reports, APSM Proprietary Analysis

Featured Image: Public Domain / Instagram

Disclaimer: This article contains general financial information for educational purposes and does not constitute professional advice.

“you know, yourselves are God’s temple and that God’s Spirit dwells in your midst?”

– Corinthians 3:16