Federal tax refers to taxes collected by the U.S. federal government on gross income, investments, and certain transactions that are not considered to be capital gains.

For athletes, federal tax is the largest and most consistent tax obligation, applying regardless of which state they play in or where they live.

Even athletes in no-income-tax states still pay federal tax.

It is unavoidable and forms the base layer of all tax planning.

How Federal Tax Applies in Different Leagues

🎓NCAA / NIL Athletes

For NCAA athletes, federal tax is often the first unavoidable tax exposure tied to NIL income.

Even modest earnings trigger federal filing requirements, and taxes are owed regardless of age, student status, or dependency claims.

Early understanding of federal tax helps prevent under-withholding and unexpected liabilities.

Use Cases

- NIL endorsement income

- Social media monetization

- Appearance fees

- Scholarship-related taxable income

Example

A college athlete earns $60,000 from NIL deals. Even if they live in a low-tax state, federal income tax applies immediately and must be planned for long before filing season.

🏈NFL

In the NFL, federal tax represents the baseline cost of earning income, applied before any state or jock taxes are considered.

Large signing bonuses and salaries push players into the highest federal brackets quickly, making federal tax the largest single reduction to gross earnings across a season.

Use Cases

- Player salary and signing bonuses

- Endorsements and licensing

- Performance incentives

- Off-field business income

Example

An NFL player earning $3 million owes federal tax before accounting for state or jock taxes, often resulting in over one-third of gross income going to the IRS.

🏀NBA

NBA players routinely operate at the top federal tax brackets, where marginal rates significantly reduce take-home pay.

With guaranteed contracts and endorsement-heavy income, federal tax becomes the dominant expense shaping net income, lifestyle decisions, and long-term strategy.

Use Cases

- High-income brackets

- Endorsements and equity compensation

- International income exposure

- Bonus-heavy contracts

Example

An NBA player earning $45 million reaches the highest federal tax brackets, making federal tax the single largest expense in their financial life.

⚾MLB

For MLB players, federal tax applies to income timing rather than contract value. Long seasons, bonuses, and deferred compensation structures make federal tax planning essential to managing cash flow and avoiding mismatches between earnings and tax obligations.

Use Cases

- Long season income

- Deferred compensation

- Signing bonuses

- Endorsements

Example

An MLB player with deferred salary still owes federal tax based on when income is received, not when the contract is signed.

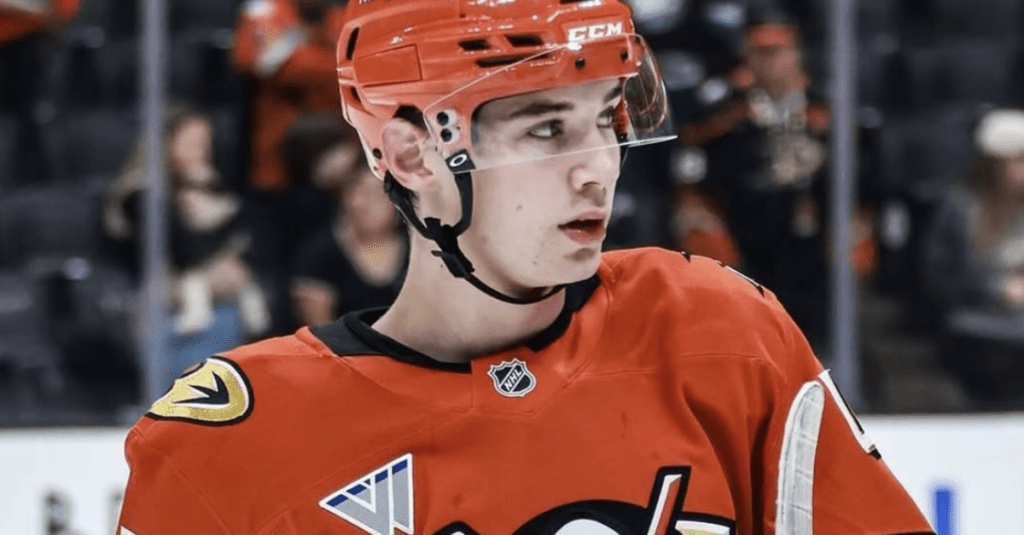

🏒NHL

NHL players earning income in the U.S. are subject to federal tax regardless of citizenship or primary residence.

Even with cross-border considerations and treaties, federal tax remains a core obligation on U.S.-sourced income, making accurate reporting and planning critical.

Use Cases

- U.S. federal taxes

- Cross-border income considerations

- Treaty-based relief

- Currency conversion

Example

An NHL player earning income in the U.S. pays federal tax even if they reside part-time in Canada.

⚽MLS / International Soccer

For soccer players classified as U.S. tax residents, federal tax applies to worldwide income, not just earnings inside the United States.

This creates complex reporting requirements and makes federal tax one of the most impactful factors in cross-border financial planning.

Use Cases

- Foreign income reporting

- Dual residency complications

- Treaty exemptions

- U.S. withholding rules

Example

A player earning income abroad while classified as a U.S. tax resident must report global income to the IRS.

🥊Combat Sports

In combat sports, federal tax applies to irregular, high-variance income streams that are often paid in lump sums and bout winnings/revenue sharing percentages from PPV.

Because fighters are usually independent contractors, federal taxes are not withheld automatically, increasing the risk of underpayment without proactive planning.

Use Cases

- Fight purses

- Win bonuses

- Sponsorship payments

- Independent contractor status

Example

A fighter receiving a lump-sum purse may owe significant federal tax immediately, even if income is irregular year to year.

⛳Golf / Individual Sports

For individual athletes, federal tax applies to U.S.-sourced prize money and sponsorship income regardless of where the athlete lives.

With frequent travel and variable earnings, federal tax planning is essential to understanding true profitability year over year.

Use Cases

- Prize money

- Appearance fees

- Sponsorship income

- International tournaments

Example

A golfer earning prize money at a U.S. tournament owes federal tax regardless of home country or residence.

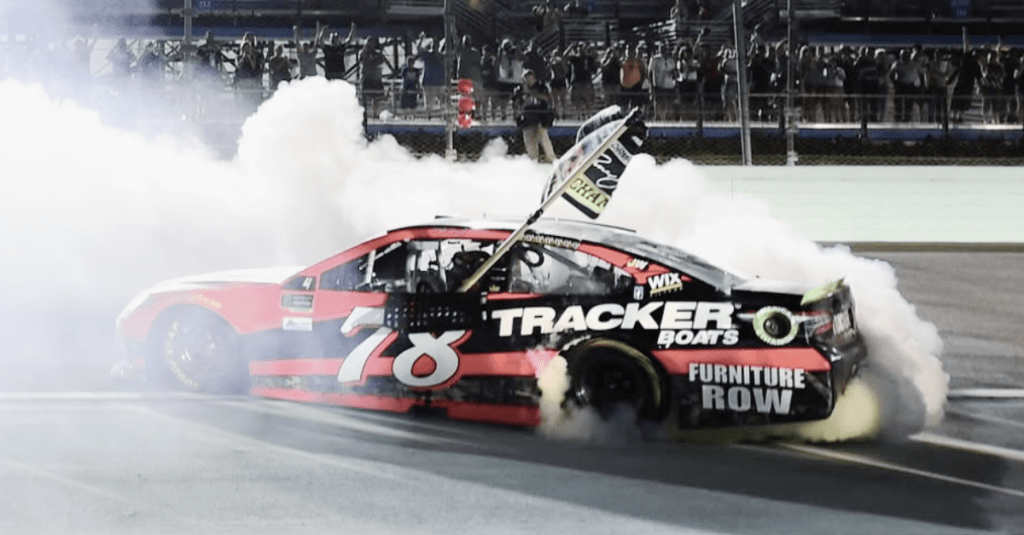

🏎️Racing / NASCAR / F1

Drivers earning income tied to U.S.-based races, teams, or sponsors are subject to federal tax even if they spend significant time abroad.

Federal tax forms the base layer of taxation before international, state, or withholding considerations from write-offs are applied.

Use Cases

- Team salary

- Sponsorship income

- Race winnings

- International appearances

Example

A driver earning income tied to U.S. events must report and pay federal tax even if living abroad part of the year.

Federal Tax vs State Tax

- Federal tax applies nationwide

- State tax depends on location and residency

- Jock tax applies to where games are played

Federal tax is the foundation, while other taxes stack on top.

Why Federal Tax Matters

Federal tax:

- Applies to nearly all athlete income

- Drives net take-home pay

- Determines effective tax rates

- Shapes contract, endorsement, and business structures

Ignoring federal tax is how athletes end up with cash-flow problems despite high income.

Related Terms

Next Reads

- Luther Burden III’s Fully Guaranteed NFL Rookie Contract

- Sauce Gardner’s $31.1 Million/Year Contract Extension

- Highest-Paid MLB Players of 2025

- Largest Contracts in Pro Sports History: Top 7 All Time

- Top 5 Longest NHL Contracts In History

May God bless us still, so that all the ends of the earth will fear him.

– Psalm 67:7