Income tax is a tax imposed on money earned through wages, contracts, bonuses, endorsements, NIL deals, appearance fees, and other forms of active income via the state a person’s primary residency.

For Instance, the State of California has the highest income tax in the U.S at 12.3% for top earners. Add this to an athletes federal tax deductions and athletes in high-income tax states end up losing over 50% of the contract value in the headlines.

States with no Income Tax, like Washington or Nevada may serve more preferable to athletes, as these states don’t charge an income tax, but do levy high-sales tax rates and property taxes to make up for it.

Student-athletes earning income from NIL opportunities should especially pay attention to income tax rates and the state where they reside, as not knowing your estimated taxes owed, can be the difference in tens of thousands of dollars when signing deals with brands or companies.

For pro athletes, income tax is the largest and most immediate tax burden, often taking priority over every other financial consideration.

Unlike capital gains, income tax applies the moment money is earned, not when assets are sold.

How Income Tax Applies in Different Leagues

🎓NCAA / NIL Athletes

For NCAA athletes, income tax is often the first tax obligation they ever face, arriving before professional contracts or major wealth.

NIL income is treated as earned income, meaning taxes apply immediately, even while athletes are still students.

Understanding income tax early helps prevent surprises, penalties, and cash flow issues during eligibility years.

Use Cases

- NIL sponsorship payments

- Social media monetization

- Appearance fees

- Merchandise revenue

- Scholarship-related stipends

Example

A college athlete earns $85,000 from NIL deals. That income is subject to federal income tax and possibly state tax, even if the athlete is still considered a dependent.

🏈NFL

In the NFL, income tax represents the largest and most consistent reduction to player earnings.

Game checks, bonuses, and endorsements are all taxed as earned income, often across multiple states due to league scheduling.

Players who ignore income tax planning early often overestimate their real take-home pay.

Use Cases

- Contracts and signing bonuses

- Game checks and roster bonuses

- Endorsements and appearance fees

- Practice squad income

Example

An NFL player earning $2.5 million in salary pays federal income tax, state income tax, and jock taxes across multiple states where games are played.

🏀NBA

NBA players typically face some of the highest effective income tax rates in professional sports, especially when playing in high-tax states.

Guaranteed contracts create stability, but income tax still absorbs a significant portion of earnings before investments or savings begin.

Strategic planning is essential to preserving long-term wealth.

Use Cases

- Guaranteed contracts

- Endorsements and equity compensation

- International income

- Performance bonuses

Example

An NBA player earning $40 million in California faces some of the highest combined income tax rates in the U.S. due to federal and state taxes.

⚾MLB

MLB players deal with income tax complexity due to long seasons and frequent travel across state lines.

Income is allocated game by game, which can result in tax obligations in dozens of states and tax jurisdictions.

Income tax planning plays a major role in net income consistency over a long career.

Use Cases

- Income across many states

- Signing bonuses

- Deferred compensation

- Endorsements

Example

An MLB player earning income across 20+ states must allocate income and pay jock tax in each applicable jurisdiction.

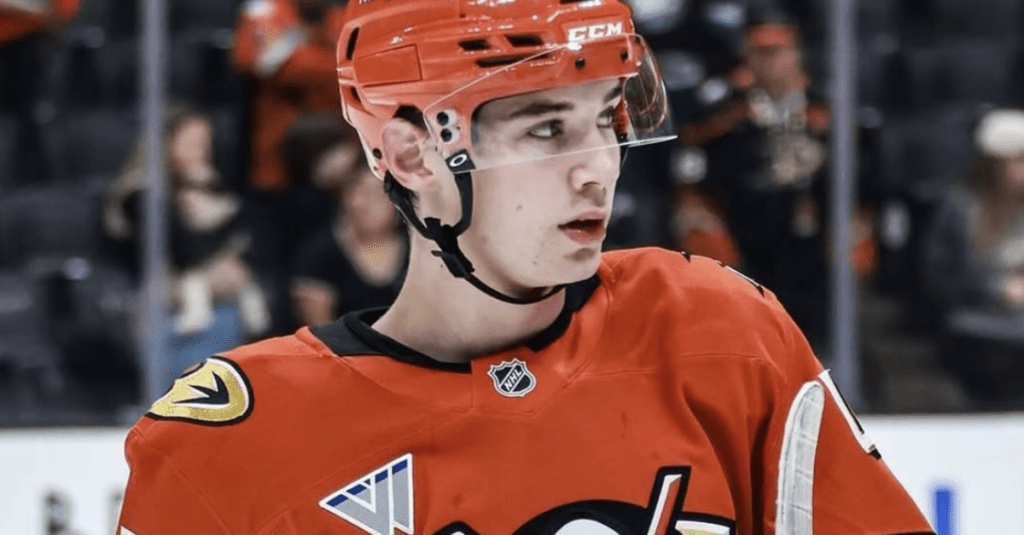

🏒NHL

For NHL players, income tax is shaped by cross-border rules, currency differences, and treaty provisions.

Playing in both the U.S. and Canada introduces multiple tax authorities and reporting requirements.

Income tax awareness is critical to avoiding double taxation and maintaining accurate net income expectations.

Use Cases

- U.S. and Canadian income

- Currency conversion

- Treaty-based taxation

- Multi-country tax filings

Example

An NHL player earning income in both Canada and the U.S. must navigate two tax systems and foreign tax credits.

⚽MLS / International Soccer

Soccer players often earn income in multiple countries, making income tax heavily dependent on residency status and international treaties.

Earnings may be taxed differently based on where the athlete lives, plays, or is contractually based.

Income tax planning helps stabilize take-home pay in a global sport.

Use Cases

- Foreign club income

- National team compensation

- U.S. residency vs foreign residency

- Treaty exemptions

Example

A soccer player earns income in Europe and the U.S. Income tax treatment depends on residency status and tax treaties.

🥊Combat Sports

In combat sports, income tax applies to lump-sum payouts that can create a false sense of financial security.

Fighters are typically classified as independent contractors, meaning taxes are not withheld automatically.

Understanding income tax obligations is critical to avoiding post-fight financial strain.

Use Cases

- Fight purses

- Win bonuses

- Sponsorship payments

- Independent contractor status

Example

A fighter earns $250,000 for a bout and owes income tax in the state where the fight occurred, regardless of home residence.

⛳Golf / Individual Sports

For golfers and individual athletes, income tax applies across multiple jurisdictions as prize money is earned worldwide.

Because expenses are ongoing and income fluctuates, income tax can significantly reduce annual earnings.

Net income depends heavily on disciplined tracking and planning.

Use Cases

- Tournament winnings

- Appearance fees

- Sponsorship income

- International earnings

Example

A golfer earns prize money in multiple countries and must report income tax in each jurisdiction.

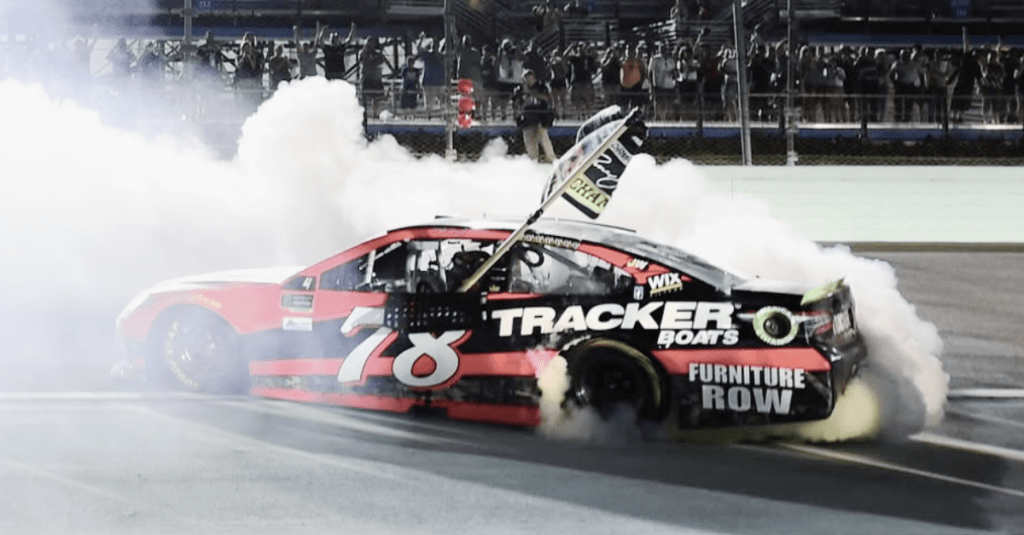

🏎️Racing / NASCAR / F1

Drivers earn income from multiple sources, including sponsorships and international events, each with distinct tax treatment.

Income tax obligations can span states and countries, complicating compliance and planning.

Understanding income tax ensures that profitability is measured accurately, not just by headline earnings.

Use Cases

- Race winnings

- Sponsorship contracts

- Team salary

- International income streams

Example

A driver earns income in several states and countries, triggering complex income tax reporting obligations.

Income Tax vs Other Taxes

- Income tax applies to earned money

- Capital gains applies to profits from asset sales

- Self-employment tax applies to independent contractors

- Payroll taxes fund Social Security and Medicare

Athletes often face multiple layers of tax on the same dollar.

Why Income Tax Matters

Income tax:

- Is unavoidable on earned money

- Hits before wealth-building begins

- Drives residency decisions

- Shapes contract and endorsement structures

Reducing income tax legally is often the first step toward financial stability for athletes.

Related Terms

Next Reads

- Garrett Wilson’s $130 Million Contract with the New York Jets

- Juan Soto Signs the Biggest Contract in MLB History

- Luka Dončić Lost $345 Million

- Why NHL Players Flock to Florida Teams

- Top 5 Wealthiest Golfers of All Time

Just as the Son of Man did not come to be served, but to serve,

and to give his life as a ransom for many.

– Matthew 20:28