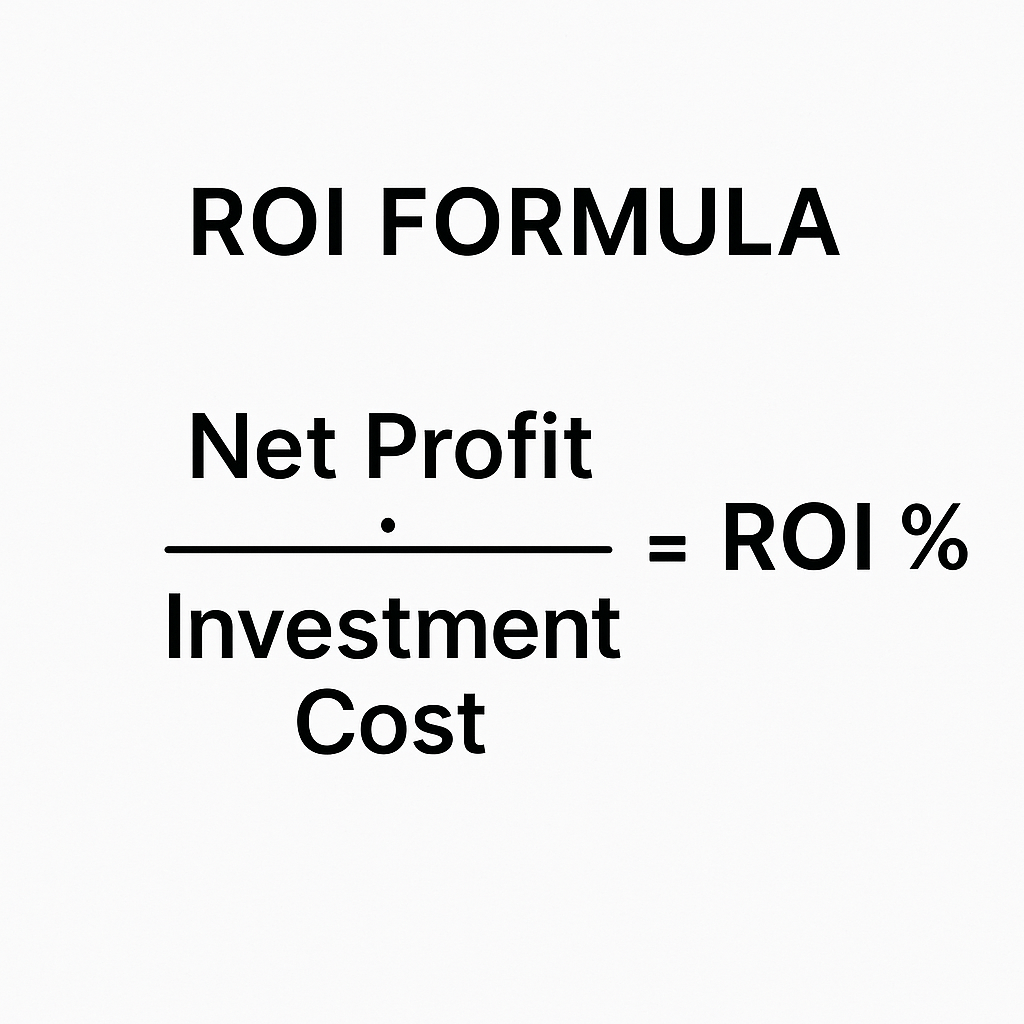

Return on Investment (ROI) is a performance metric used to valuate the efficiency or profitability of an investment.

It measures the return gained from an investment relative to its cost.

For athletes, teams, sponsors, and leagues ROI determines if their time, money, or resources were worth it.

Whether it’s a free-agent contract, a real estate flip, a sponsorship deal, or even a content strategy, ROI is the scoreboard.

If you spent $100,000 on a project and earned $130,000 back, your ROI is 30%.

How Different Leagues Earn ROI

🎓NCAA / NIL Athletes

For NCAA athletes, ROI centers on turning limited eligibility and early exposure into long-term earning power. Since athletes are not salaried employees, ROI is measured less in wins and more in brand growth, NIL revenue, and future leverage.

Every decision from training, transfers, content, representation, and endorsements, are evaluated by what it returns relative to time, money, and opportunity cost.

Use Cases

- Evaluating whether paying for trainers, nutrition, or private facilities improves performance and NIL value

- Determining if a transfer portal move increases exposure, playing time, or endorsement opportunities

- Measuring the ROI of hiring an agent, manager, or marketing team

- Assessing whether content creation (YouTube, X, Instagram) generates enough NIL income to justify time investment

- Choosing sponsorships based on long-term brand alignment vs short-term payouts

For NIL athletes, ROI is often delayed. The payoff may come after college, through draft position, professional contracts, or sustained brand equity.

Example

A college athlete spends $20,000 annually on training, content production, and brand development.

That investment leads to $75,000 in NIL deals, stronger on-field performance, and increased national exposure.

The immediate ROI is positive, but the larger return comes from improved draft stock and future professional earnings.

For NCAA athletes, ROI isn’t just about cash today, it’s about converting investments into career longevity and post-college income.

🏈NFL

How It’s Used

NFL teams and players rely on ROI when evaluating contracts, training programs, free agent signings, and sponsorships.

Use Cases

- Franchises assess whether paying a player $25 million/year generates enough wins, playoff revenue, or merchandise sales to justify the deal.

- Players use ROI to gauge if investing in a private trainer, nutritionist, or off-season home pays off in performance/income.

- Sponsors look at engagement (TV time, jersey sales, social media views) to see if the partnership was worth it.

- Ownerships uses ROI to determine the ROI potential for new stadiums or if they are better off rebuilding. The Bengals for instance, struck a deal with Hamilton County, Ohio to renovate Paycor stadium and keep it where it currently sits.

🏀NBA

How It’s Used

The NBA uses ROI metrics for everything from player deals to marketing campaigns.

Use Cases

- ROI is used to compare superstar contracts vs ticket sales, jersey revenue, and fan engagement.

- Used heavily in arena investments, G-League expansions, and endorsement deals. Similar to the NFL, but with different metrics due to stadium size, fanbase size and market potential.

Example

LeBron James signing with the Lakers skyrocketed ticket sales, viewership, and team valuation.

His ROI was instantly profitable both on and off the court. He did not earn over $300 million during his career until the 2020’s when he joined the Lakers and since joined the pro athlete billionaires club.

🧳MLB

How it’s used

Since MLB has no salary cap, teams are hyper-conscious of dollar efficiency.

Use Cases

- Used when deciding if a player with a $30 million/year deal delivers enough WAR (Wins Above Replacement).

- Long-term contracts for pitchers are evaluated yearly by ROI, based on injury risk and effectiveness.

Example

Shohei Ohtani’s marketing power and global reach make him a high-ROI athlete, even when recovering from injury.

The Dodgers didn’t just pay for a player, they paid for a brand asset.

Ohtani will continue to generate revenue for the Dodgers even after he retires from baseball.

🏂NHL

How it’s used

NHL uses ROI less publicly, but still applies to TV deals, arena investments, and franchise relocation.

Use Cases

- Teams evaluate whether high-salary veterans still provide value.

- ROI often comes into play for team owners evaluating profitability on stadium upgrades or regional expansions.

Example

Sidney Crosby’s long-term presence in Pittsburgh delivered ROI in ticket sales, national exposure, and overall franchise value increase.

⚽MLS & International Soccer

How It’s Used

In global soccer, ROI is one of the most important financial metrics because clubs operate like investment portfolios.

Every player acquisition, whether a $500K MLS signing or a $100 million European transfer, talent is judged by what they produce in:

- Ticket sales

- Shirt sales

- Social media growth

- International fanbase expansion

- Tournament qualification (Champions League, CONCACAF, etc.)

- Sponsorship deals

- Future transfer resale value

Unlike American leagues, soccer has transfer markets, meaning ROI is often tied to buy talent low, develop them, and then sell high.

Use Cases

- MLS clubs use ROI to evaluate young talent from South America or Europe. If a $2 million teenage signing becomes a $10 million export to the Premier League, the ROI on the player for the American club is enormous.

- European giants (Real Madrid, Bayern, Man City) judge ROI on global brand expansion, not just performance. One superstar signing can increase worldwide revenue for a decade.

- Smaller clubs rely on ROI to survive, they invest heavily in academies expecting a financial return when their young players are sold.

In soccer, ROI is not just financial, it directly impacts promotion and relegation, tournament earnings, and club valuations.

Example

Inter Miami signing Lionel Messi was the largest ROI event in MLS history. Ticket sales increased 10x, the club’s valuation doubled, international viewership exploded, and global brands lined up for partnerships.

In Europe, Borussia Dortmund bought Erling Haaland for ~$20 million and sold him for ~$60 million two years later after gaining millions in ticket revenue, jersey sales, and Champions League performance bonuses, a textbook ROI masterclass.

🥊UFC / Combat Sports

How It’s Used

Fighters and promoters live and die by ROI.

Use Cases

- A fighter may spend $500K on camp and recovery and needs a purse big enough to justify it.

- UFC determines fight cards based on fighters’ draw power, not just talent.

- WWE contracts for stars like John Cena or Roman Reigns are negotiated based on merch sales and ticket bump.

Example

Conor McGregor reportedly brings in $100+ million per card, even with a massive guaranteed purse the UFC gets elite ROI.

⛳Golf / 🎾Tennis / 🎿Individual Sports

How it’s used

Athletes calculate ROI on training, travel, coaching, and equipment.

Use Cases

- If a player spends $30K/month on tour-related costs, ROI means breaking even and cashing big purses consistently

- For LIV Golf or endorsement-heavy athletes like Federer or Serena, ROI is media-based.

Example

Tiger Woods’ ROI as a Nike athlete is hundreds of millions in sales for what started as a rookie deal when he was an amateur golfer on the rise.

🏎️Racing / NASCAR / Formula 1

How it’s used

ROI is crucial in motorsports, a sport where everything is expensive.

From engines, to travel and staff, as well as marketing.

Racing does not get the same exposure as other major sports.

So they have to strategic in the way that they evaluate investments and chart ROI.

Use Cases

- Teams measure every dollar spent vs wins, podiums, and viewership.

- Sponsors want drivers who move the needle both in race results and branding.

Example

Lewis Hamilton’s sponsorship appeal, global platform, and championship success give him one of the best ROI packages in modern racing.

Why ROI Matters

ROI is how business wins are measured. In sports, everything is an investment.

Contracts, brand partnerships, stadiums, and personal development.

- Teams don’t just pay for performance, they pay for return.

- Athletes don’t just spend money, they leverage it.

Knowing the ROI on a move, a person, or a contract tells you if it was worth it.

It helps front offices, sponsors, players, and analysts judge the success of their business ventures and investments.

🔗Related Terms

🔗Next Reads

- Inside the Bengals’ $470 Million Stadium Renovation Deal

- Why U.S. Investors are Buying European Soccer Clubs

- How Media Rights & Streaming Deals Influence Player Salaries

- Apollo’s $5 Billion Private Equity Fund Explained

- Dick’s Sporting Goods Acquires Foot Locker

📊Graphic

Whoever serves me must follow me; and where I am, my servant also will be. My Father will honor the one who serves me.

– John 12:26