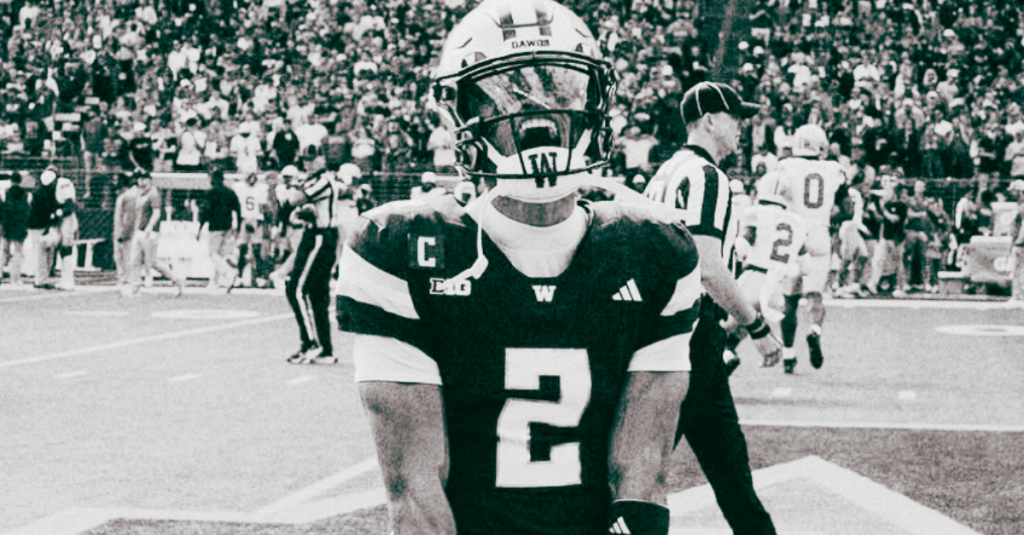

Demond Williams Jr. and the University of Washington may have officially pushed college football into a new phase of its economical evolution.

It was reported that Williams was earning ~$5 million for his 2025-2026 campaign with the Huskies, who finished 9-4 (5-4) on the year.

Now, the potentially rising new college football star plans to enter the transfer portal and the University of Washington could sue.

Quarterbacks in the new era of NIL move more like professional athletes than students.

UW could seek to recover damages, as NIL collectives act like bidders, and negotiations about money mirror free agency without having actual formal contracts with their schools.

The transfer portal was always going to test the limits of the NIL market.

The situation surrounding Washington Huskies QB Demond Williams Jr. is a new step in testing the limits of the college football NIL market and an athletes’ earning potential when jumping ship.

It is rumored that Williams plans his reported move toward LSU for ~$6.5 million, and UW’s plan to pursue damages means they intend to recoup their investment.

It also marks a clean break from the original collegiate-income model.

The new reality is simple:

College football is now like a pro contracts marketplace.

Markets have contracts.

Contracts create leverage.

Leverage creates litigation.

And litigation is how you know an industry has matured.

NIL Isn’t “Side Money” Anymore

For decades, the NCAA held the position that compensation beyond athletic scholarships was a threat to amateurism.

That model has entirely collapsed with the legalization of NIL.

Today elite collegiate athletes can command multi-million dollar NIL packages from university collectives who compete for talent in a similar way to contracts, but in another name. Instead, boosters function as capital pools that are a new testament to the financial evolution of collegiate sports.

While competition has seen more parody in college football since the legalization of NIL by the Supreme Court, it is now based on what schools pay for the best talent vs. developing the right players.

In NCAA and pro-sports agents are usually the person who manages their athlete deal flow and school brand equity determines athlete valuation. Agents charge fees in the 2-5% range of contracts and ensure that they represent their athletes to the best of their ability to land sponsors. endorsements and brand deals to generate players NIL income.

Demond Williams Jr. was reported to be earning ~$5 million at UW, with the majority from NIL sponsorships, donor collectives, and brand partnerships, not salary from the school itself.

This distinction matters financially and legally. UW does not pay him like an NFL team pays a quarterback.

The university provides:

- AD benefits

- Academic support

- Housing

- Training infrastructure

- Brand exposure

And NIL entities supply the cash.

This structure creates a unique market: The school benefits from his play, but does not directly employ him. (1099 form)

What “Damages” Actually Means in NIL

Most would assume that UW suing their starting Quarterback means he committed some type of employment violation or caused a contract dispute. This is not how it works in the NCAA and collegiate sports.

NIL disputes fall into a “hybrid” category:

- commercial contracts

- collective agreements

- donor-backed deals

- brand sponsorships

- third-party agency agreements

- portal eligibility rules

UW’s rumored legal posture likely falls under economic damages, not payroll breach.

Possible damages include:

- Lost NIL ecosystem value: If Williams leaves, UW’s NIL market becomes less valuable. Donors pull back. Collectives lose ROI. His leverage drops.

- Loss of expected future performance value: A returning starting QB is an asset. That asset boosts ticket sales, broadcast exposure, merchandise, recruiting halo effects, and donor engagement.

- Breach of implied agreement: Even without salary, benefit agreements and NIL frameworks can establish enforceable expectations.

- Tortious interference: If LSU or intermediaries induced a move prior to portal compliance, that’s a classic business tort.

- Competitive harm: Quarterback departures can alter future revenue outcomes tied to on-field performance and postseason earnings.

You don’t sue because someone left.

You sue because their exit alters the financial model you rely on for revenue generation and reputation.

The Huskies collective invested a lot of money into Williams.

UW does not want the young QB to transfer before they make a return on their investment, hence the damages they would sue him for.

The Portal Is Functioning Like Free Agency Without the Contracts

Williams allegedly leaving UW for a $1.5–$1.6 million increase in income is not a betrayal story.

It’s a price discovery story and a look behind the curtain of the new era in college football with NIL.

This is what contracts markets do when they are tied to third-parties and not directly between the employer (university) and the employee (athlete).

In the NFL, NBA, MLB, and NHL, price discovery happens through:

- restricted free agency

- arbitration

- qualifying offers

- franchise tags

- cap sheets

- collective bargaining

College football skipped all that and went straight to open bidding.

Players can now:

- move for more money

- renegotiate annually

- chase brand exposure

- optimize for scheme fit

- maximize earnings before draft eligibility

This is rational athlete behavior. What’s irrational is pretending the sport didn’t become a marketplace.

The Agent Layer Changes Everything

With the reported split between Williams and his agent, another layer of financial implications arise, that agents allocate an athletes’ bargaining power.

To be a rising star in college football comes the expectation of professionalism, especially when millions are involved.

With professionalization comes:

- representation

- negotiation

- valuation

- timing strategies

When agents pull out, it signals either:

- a failed negotiation

- risk to reputation

- chaotic bid structure

- unenforceable deal terms

- high litigation exposure

In pro sports, you rarely see voluntary agent exits mid-deal unless the market structure is unstable.

College football’s NIL market is very unstable.

This Case Sets Precedent, Precedent Sets Rules

When a lawsuit or damages claim enters an unregulated market, the outcome does more than resolve a dispute, it defines the rules of the next cycle of the NIL era.

There are three likely outcomes that may impact the collegiate sports industry:

Outcome 1: NIL Becomes Contractual

If courts treat NIL agreements as enforceable contracts, we move closer to:

- buyout clauses

- termination clauses

- matching rights

- protected compensation

- non-competes (or portal equivalents)

- revenue-based incentives

This looks more like pro sports.

Outcome 2: Collectives Become Formal Employers

If damages are tied to performance value, collectives may need to:

- standardize compensation

- issue formal offers

- establish legal employment status

- pay taxes like employers

- negotiate representations + warranties

This looks like entertainment law + private equity.

Outcome 3: Valuation Models Emerge

If athletes are assets, markets will price them. Valuation for QBs in particular will include:

- NIL revenue

- draft projections

- social audience value

- donor leverage

- institutional fit

- scheme-specific production

This looks like Wall Street.

Why Demond Williams Jr. Leaving UW Matters

The Demond Williams Jr. story is not the usual, “Quarterback enters the transfer portal for more money.”

The real story is, “The CFB labor market discovered the price of early-career QB talent.”

And once a market discovers price, more price discovery follows.

This is how new economic eras begin inside capitalists industries.

The Transfer Portal Is Becoming the Rookie Contract + Arbitration + Free Agency Window

NFL structure:

- Rookie contracts have fixed pay

- Arbitration increases leverage

- Free agency unlocks market value

The portal collapses all three into one. It lets players capture their value upfront, not 3–5 years later based on their performance over the lifetime of their rookie deal. From a wealth standpoint, that’s massive.

The average NFL career is ~3.3 years.

Most CFB stars monetize during their peak media window, before deciding if they will be entering the draft. The use of the transfer portal turns that window liquid for college football players and is a primary reason as to why athletes are seemingly changing schools after every season in order to chase a bag.

What Comes Next for College Football

Expect the following shifts:

- More lawsuits

- More collective regulation

- More agent participation

- More contractual clarity

- More valuation modeling

- Bigger donor capital pools

- Earlier bidding for elite QBs

- Higher NIL ROAS expectations (return on athlete spend)

- Media rights adjusting to player liquidity

College football stopped being amateur years ago. This is just the paperwork catching up.

Controversy vs. Catalyst

Demond Williams Jr. isn’t the controversy. He’s the catalyst.

If this legal fight escalates, it won’t be the last NIL lawsuit.

It will be the first major case that defines how value moves in college football’s contract era.

Want to Learn the Wealth Framework

All Elite Earners Use?

The APSM “7 Primary Ways Athletes Build Generational Wealth” Report Includes:

- Core wealth engines used by the world’s top earners

- Multi-contract wealth acceleration modeling

- Real-estate & portfolio structures designed for long-term stability

- Tax-efficient income routing

- Brand, endorsements & equity playbooks

- Risk-tier modeling athletes use to build & protect their net worth

If you want the real path to lifelong wealth, not hype, not cliches, this is the foundation.

Next Reads

- Inside the House v. NCAA Settlement and Its Impact on College Sports

- What NCAA’s New Betting Rules Mean for Future Gambling Revenue

- Inside the NCAA’s New Partnership with Genius Sports

- Arch Manning’s Slow Start May Impact His Endorsement Deals

- CFP Championship 2025: Revenue & NIL Impact

Credits

Written By: Aidan Anderson

Research & Analysis: Apostle Sports Media LLC

Sources: ESPN, On3, Sportico, CBS Sports, X Reporting, APSM Proprietary Analysis

Featured Image: Public Domain / Wiki Commons / Instagram

Disclaimer: This article contains general financial information for educational purposes and does not constitute professional advice.

I have not come to call the righteous, but sinners to repentance.

– Luke 5:32