Juan Soto has now made history alongside the New York Mets franchise, as he and the team agreed to terms on a 15-year/$765 million contract prior to the start of the 2025 MLB season.

The move came as a shock to many, fans, players and franchises alike were all taken aback when the news was officially announced.

Soto joined the Yankees after his second trade in 17-months, prior to the start of the 2024-2025 MLB season. Soto was shuffled between Washington, San Diego and then New York between the 2022 and 2024 MLB seasons;

Still managing to hit 35+ HR & 109 RBI’s in his previous two seasons. He also holds a.285 career batting average, 0.421 OBP and .533 SLG.

News broke that Soto did receive a contract offer from the Yankees to the tune of 16-years/$760 million, however Soto chose the cross-town rival Mets.

Due to the signing, the New York Mets front office has now spent over one billion dollars during the summer leading into the 2025-2026 league year.

It is also worth noting, that while Soto did sign the largest total contract value in MLB history, he still sits behind Shohei Ohtani for the first place position of average salary per season.

- Soto Yearly Salary Average: $51,000,000

- Ohtani Yearly Salary Average: $70,000,000

Still at the age of 26, this contract for Juan Soto locks him up contractually until his age 41 season.

So, unless traded for a fourth time in his career, Soto will remain a cross-town rival with his former team and World Series Runner-ups in 2024 the New York Yankees, for the foreseeable future.

The Mets franchise in recent memory has been known for spending outlandish dollar amounts during free agency, to still not make a solid run for a championship since 1986.

Will Soto be able to finally assist the NYM in getting over the 40-year drought and back into the World Series to compete for a ring?

Or, is the money due to the name, image and likeness of Soto; more than it is about the product he displays at the plate.

Only time will tell.

For now, let’s take a deeper look into this massive contract and the true take-home earnings Soto will get after tax-implications and how he can make sure he pushes his already multi-generational wealth, even further down the Soto family line.

Contract Details

- 15-years/$765 million (fully guaranteed)

- Average Salary: $51 million

- Base Salary: $46,875,000

- Signing Bonus: $75 million

- Total Salary: $61,875,000

- Next Free Agent Status: 2040

Tax Implications

Yearly Tax & Team Expenses Implications: ~$26.8 million

- Federal tax (37%): ~$18.9 million

- New York tax (10.9% on home games + ~8% overall): ~$4.08 million

- Agent (5%): ~$2.5 million

- Lawyers & Misc. Fees (1-2%): $1 million-$1.5 million

- MLBPA Dues: ~$85K per year

Average Yearly Pay: ~$24.2 million

Total Taxes Overall: – ~$400 million

- Federal tax (37%): ~$283 million

- New York tax (10.9% on home games + ~8% overall) = ~$61.2 million

- Agent (5%): ~$38.2 million

- Lawyers & Misc. Fees (1-2%): ~$15-$20 million

- MLBPA Dues: ~$85K per year x 16 = ~$1.4 million

The above is exactly why everyone should have a basic understanding of finance and know how to hire the best wealth management team around them.

Because without the help of some serious finance wizards, Soto’s Overall Contract Estimated Take Home Pay Without Write Offs & Tax Savings Strategies: ~$365 million.

He will have lost roughly 50% or more of his total contract value in just taxes.

As seen, the contracts of MLB players are indeed massive and due to their being no salary cap in the league, top talent tends to be paid hundreds of millions more in total contract values than other leagues.

However, due to the mandatory expenses of ball players prior to being to buy anything for themselves, Juan Soto will likely lose roughly half of his total contract amount over its lifetime.

If Soto is smart, or at the very least surrounds himself with an intelligent and capable investment and wealth building advisement team he should do the following: Invest money into stocks, real estate and physical assets that allow for him to write some of his yearly tax burden down.

When unrealized profits are inevitably collected at a later date, if done strategically, Soto would be able to live off 4% of his total account value yearly while still compounding another 3-5%.

If Soto Invested 20% Into A Stock Portfolio

Let’s say Juan Soto decided to stack generational wealth the right way and started by investing 20% ($10.2 million) of his average yearly salary ($51 million) into a safe, consistent growth asset like the S&P 500.

Here’s how those compounding gains would shake out over time, assuming an average ~8% annual return.

| Age | Years Invested | Value at 8% Return |

|---|---|---|

| 30 | 4 | ~$45.96M |

| 35 | 9 | ~$127.37M |

| 45 | 19 | ~$422.75M |

| 65 | 39 | ~$2.44B |

So yes, you read that right. If Soto just invests $10.2M per year, lets it sit, and lets the market ride, he could potentially see over $2.4 billion in returns by age 65.

That’s generational wealth on top of generational wealth.

Keep in mind, this doesn’t include real estate gains, endorsement income, or even tax-advantaged accounts. It’s just one slice of the pie.

Soto if he chooses strategy over lifestyle, will be able to live an astounding life of wealth and access while having the opportunity to become a multi-billionaire by the normal retirement age of the average working American.

While you cannot take that kind of money to the grave, Soto will be able to pay it forward to his next family generations, for the next 3+ cycles of Soto’s. Juan Soto always had his eyes on the prize when he got signed as an international Free Agent at just age 16 out of the Dominican Republic.

While he likely felt a sense that he was dominant at the sport due to the recognition so young, he has steadily improved and become a Superstar today. It is doubtful that even himself could foresee a contract coming to him worth 3x that of Deshaun Watson’s, which is the NFL’s largest guaranteed deal in history.

Soto could make back his $400M lost to taxes over the next 16 years by only investing in the proper index and mutual funds portfolio, but the amount of other financial opportunities are endless once you hit the near billionaire status.

He now has the leverage of his own financial future and hopefully will not make hasty and rash money decisions.

Soto also purchased a ~$25M mansion as his personal residence.

It is not just a home or asset, it is the start of Soto building a multi billion dollar brand and holding his money in physical assets that are prone to appreciate.

Mets Cap Status & Spending Strategy

The New York Mets, unlike the Dodgers with Ohtani’s $700M deal, did not defer Juan Soto’s contract.

It was fully guaranteed and will be paid as intended over the next 16 seasons and not a year more.

This means every dollar he earns hits the books in real time. The Mets operate under Steve Cohen, the wealthiest owner in baseball, who’s made it clear he’s willing to treat the team as a long-term asset class like a hedge fund with home runs.

No deferments needed. Just straight cash. But with that, comes added pressure every time Soto steps up to the plate. Soto is no longer just the average MLB player, he is a spectacle.

2025 Payroll Overview

- Mets 2025 Total Payroll: ~$400M+

- Soto Share of Total Payroll: ~13%

- Competitive Balance Tax (CBT): Blown to pieces

While the Dodgers deferred most of Ohtani’s money into the 2040s to dodge the CBT (aka “luxury tax”), the Mets chose the opposite.

Take the cap hit now, maximize Soto’s prime, and try to win.

While the Dodgers strategy to some may seem smarter as the franchise is able to afford other stars and top talent, Ohtani is roughly 4 years older than Soto.

This means that LA feels as if they have a smaller window to make real championship moves, while the Mets have the ability to continue building around Soto every season.

It is a true rabbit vs turtle race with money between the Mets and Dodgers Front Offices.

With the Dodgers winning the title in 2024, the Mets now have their chance to respond.

This means Cohen and crew will have to finesse roster management with rookie-scale contracts, strategic one-year deals, and foreign signings that don’t break the bank.

Look for the Mets to rely heavily on player development and value adds around Soto.

However if the team drafts and trades right, they could build a pre arbitration super squad around Soto within the next half decade.

Think low-cost bullpen arms, platoon bats, and possibly trading for stars on expiring deals if contention is within reach.

However, if the Mets front office manipulates the salary cap correctly, the NYM may be able to start building a top heavy roster like the Dodgers over time.

With Soto likely having another decade or longer in his prime prior to any sort of decline he may have the Mets have locked in who they believe is a top talent in the league and gives them a chance at brining a title to their city.

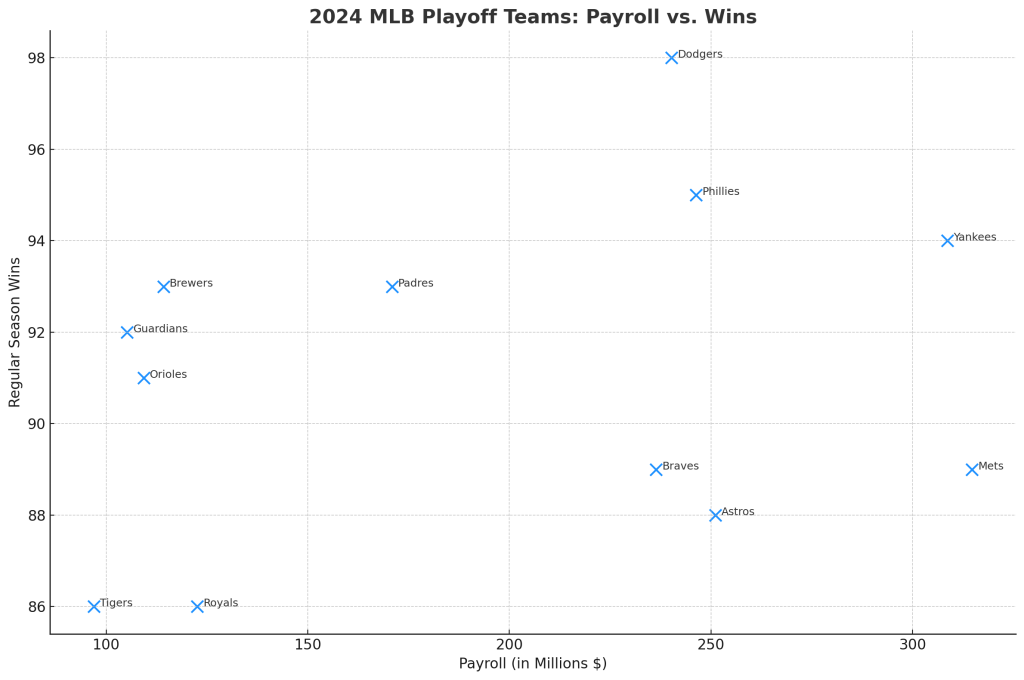

📊2024 MLB Playoff Teams: Payroll vs. Wins

Here’s a breakdown of the 2024 playoff teams, their total payrolls, and regular-season win totals:

| Team | 2024 Payroll ($M) | Wins |

|---|---|---|

| New York Yankees | 308.6 | 94 |

| Philadelphia Phillies | 246.3 | 95 |

| New York Mets | 314.7 | 89 |

| Los Angeles Dodgers | 240.2 | 98 |

| Houston Astros | 251.1 | 88 |

| Atlanta Braves | 236.4 | 89 |

| San Diego Padres | 170.9 | 93 |

| Milwaukee Brewers | 114.2 | 93 |

| Baltimore Orioles | 109.3 | 91 |

| Cleveland Guardians | 105.2 | 92 |

| Kansas City Royals | 122.6 | 86 |

| Detroit Tigers | 97.0 | 86 |

Payroll figures are approximations based on available data.

🔍Observations

- High Spend, High Reward: Teams like the Yankees, Phillies, and Dodgers invested heavily in their rosters and saw corresponding success in the win column.

- Efficiency Standouts: The Brewers and Guardians achieved impressive win totals with more modest payrolls, highlighting effective resource utilization.

- Value Picks: The Orioles and Tigers managed to secure playoff spots with relatively low payrolls, showcasing strong player development and scouting.

📊Graphic

To better illustrate the relationship between payroll and wins among these playoff teams, here’s a scatter plot: This chart plots each team’s payroll against their regular-season wins, providing a visual insight into spending efficiency.

Want Every APSM Report In One Place?

The APSM Master Report Bundle includes all current APSM reports:

- Travis Hunter’s 2025 Net Worth Valuation

- Tyrese Haliburton’s 2025 Net Worth Valuation

- 7 Ways Athletes Build Wealth

- 7 Ways Athletes Go Broke

- (Will Include future additions of reports as APSM grows)

You’ll Get:

- Deep financial literacy designed through a sports lens

- Net Worth projections, contract forecasts & tax modeling

- Wealth frameworks & risk analysis

- Lifetime value mapping for both athletes and professionals

The most valuable way to learn the game of money through APSM.

Next Reads

- Inside Juan Soto’s $25 Million Beverly Hills Mansion

- Highest-Paid MLB Players of 2025

- How the Dodgers’ Ownership Built a Multi-Billion Dollar Sports Empire

- How the Detroit Tigers Rebuilt their Franchise

- Why the Seattle Mariners Remain a Small-Market Team

Credits

Written by: Aidan Anderson

Research and Analysis: Apostle Sports Media LLC

Sources: Spotrac, MLBPA, Forbes, Athlete VC Disclosures, Public Tax Filings, MLB Payroll database, APSM Proprietary Analysis.

Featured Image: Public Domain / Wiki Commons

Disclaimer: This article contains general financial information for educational purposes and does not constitute as professional advice.

“Plans fail for lack of counsel, but with many advisers they succeed.”

– Proverbs 15:22