The NBA salary cap is one of the most intricate financial structures in all of professional sports.

It is designed to not only to create a level playing field, but also to influence team strategies, player salaries, and franchise success.

At first glance, it may seem like a simple financial framework that limits how much a team can spend, but in reality, it’s a living, breathing system that evolves with the league’s revenue model, market conditions, and collective bargaining.

Salary Cap Meaning

The salary cap represents the maximum amount of money a team can spend on player salaries in a given season.

However, there’s far more than meets the eye. Teams need to navigate a web of exceptions, contract types, and luxury tax rules to build a competitive roster while adhering to these financial limits.

Here, we break down the salary cap and the strategic maneuvers that teams make to maximize their flexibility in a cap-locked world.

Cap Mechanics

- The Cap Limit: As of the 2025-26 season, the salary cap is set at $154.647 million, with the luxury tax threshold at $187.895 million. Teams that exceed the luxury tax must pay a repeater tax for spending over the limit.

- How Teams Use the Cap: Teams in large markets, such as New York, can capitalize on media rights, endorsement deals, and sponsorships to help balance their books while paying high salaries.

In contrast, smaller-market teams like the Sacramento Kings or Orlando Magic often rely more on draft success and mid-level exceptions to stay competitive.

Salary Cap Exceptions

The salary cap system is filled with exceptions that allow teams to build rosters without violating the cap.

These are not just technicalities, they are strategic levers that can either make or break a team’s roster construction strategy.

Here’s a look at the most important exceptions and how they tie into broader market realities:

- Bird Rights: This exception allows a team to re-sign its own free agents to contracts that exceed the salary cap. For franchises looking to retain homegrown stars (think Giannis Antetokounmpo in Milwaukee or Stephen Curry in Golden State), Bird Rights are an essential financial tool that allows them to lock up talent without being hamstrung by the cap.

- Mid-Level Exception (MLE): The MLE is a lifesaver for teams in the luxury tax or those not in a position to land top-tier free agents. This exception allows teams to offer a starting salary of $12.4M to help fill out rosters with solid role players. Teams with title aspirations (like the Miami Heat or Boston Celtics) use it to supplement their bench depth, often signing key veterans who can contribute without breaking the bank.

- Supermax Contract: The Supermax is a high-risk, high-reward contract designed to keep franchise players in their current cities. It’s a tool meant to help small-market teams like the Oklahoma City Thunder retain their superstar talent. However, it comes with a hefty price tag, as players can also earn up to 35% of a teams’ salary cap.

Market Implications

The salary cap system is designed to foster competitive balance, market forces are an inescapable reality of NBA economics.

A closer look at market size, media revenue, and local TV deals reveals why teams in major markets like Los Angeles, Chicago, and Miami often have an easier time building championship-caliber rosters, compared to teams in smaller cities.

- Media Deals and Team Revenue: The Lakers, for example, have a local TV deal worth over $200 million annually. This type of revenue lets them not only pay the luxury tax but also make aggressive moves in free agency, something smaller-market teams can rarely afford.

- Global Influence and Endorsements: Players like LeBron James or Stephen Curry are not only global icons, they also attract significant endorsement deals that go beyond the court. This financial windfall influences how teams structure contracts, especially for player marketability and international appeal.

Role of the Luxury Tax

The luxury tax was introduced as a mechanism to prevent teams from monopolizing talent by spending without limits.

Teams that go over the salary cap pay a progressively higher tax rate, which increases if they repeatedly exceed the cap in consecutive years.

This tax forces teams like the Brooklyn Nets or Milwaukee Bucks make tough financial decisions, such as letting go of high-paid players or trading them for cap relief.

For example, Golden State has spent over the luxury tax threshold in recent years, resulting in significant financial penalties. But with their global fanbase and endorsement deals, they can afford to take that hit and still compete at the highest level.

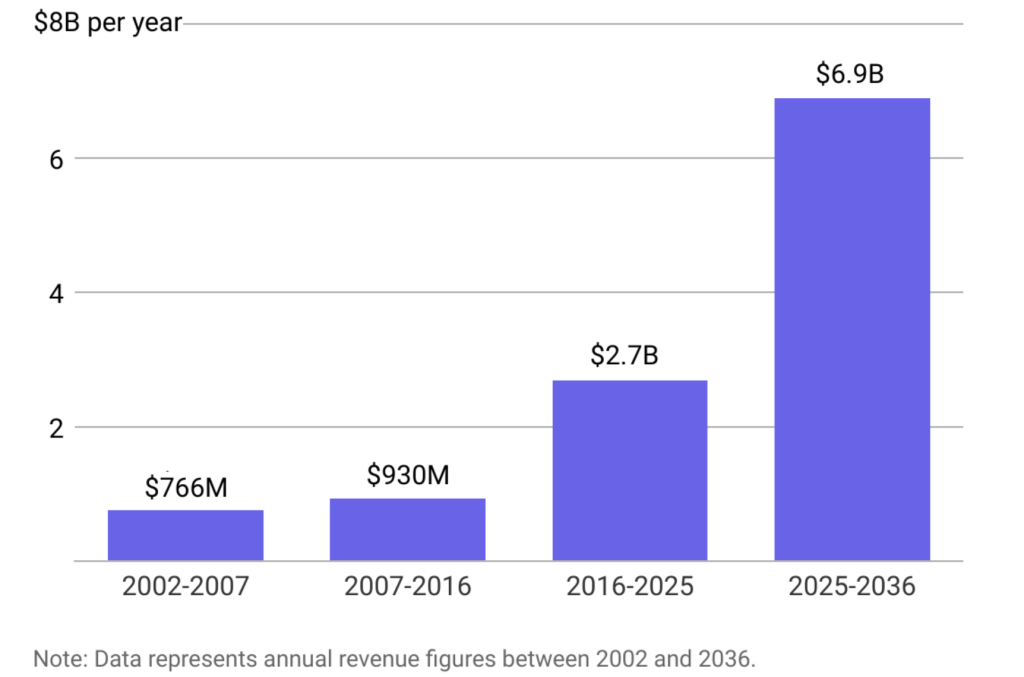

2005: cap was set at $49.5 million.

2024: cap was set at $140.6 million.

2025-26: The salary cap is set at $154.65 million for this season.

Salary Cap Balancing

The real art of the NBA salary cap lies in how teams manage their contracts over the long term.

It’s about timing: when to pay your stars, when to take a gamble on an unproven player, and when to clear space for a future free-agent haul.

Teams must be strategic about extending players, trading assets, and negotiating contracts to stay under the cap while remaining a competitive team.

- Contenders vs. Rebuilders: Championship contenders may prioritize short-term spending, leveraging exceptions like the MLE to bring in additional pieces, while teams in a rebuilding phase will focus on draft picks, development, and cap flexibility to pave the way for future success.

- Market Impact: Teams in large markets can afford to make mistakes with their finances and still recover, but small-market teams must be meticulous in their spending to ensure that each decision is part of a larger strategy for sustained success.

Where the Salary Cap Goes From Here

As the NBA continues to expand its global footprint, with burgeoning markets in places like China, India, and Europe, there’s potential for the salary cap to rise even higher in the coming years.

This could have massive implications for player contracts, especially for young players who could negotiate for even larger paydays earlier in their careers.

The Future of NBA Contracts

- Increased Revenue Streams: With streaming services like Amazon or Apple stepping into the sports media space, TV deals may evolve, bringing in new revenue that impacts the salary cap.

- Player Empowerment: Players have more leverage than ever, with max contracts, player options, and trade clauses becoming common in negotiations. The CBA will likely evolve to reflect this shift, possibly adjusting how the cap works for both teams and players.

Next Reads

- 2025 NBA Rookie Contracts Summary

- Paolo Banchero’s $239 Million Contract Extension

- Kevin Durant’s Trade to the Houston Rockets

- Luka Dončić Lost ~$345 Million

- Ace Bailey’s NBA Draft Fall Cost Him $9 Million

Credits

Written by: Aidan Anderson

Research and Analysis: Apostle Sports Media LLC

Sources: NBA CBA documents, Spotrac, Basketball Reference, ESPN Insider, Sportico, team contracts, APSM Proprietary Analysis.

Salary Cap & Financial Insights: NBA league reports, Forbes valuations, and historical cap data, APSM Financial Analysis.

Featured Image: Open AI / ChatGPT

Disclaimer: This article contains general financial information for educational purposes and does not constitute as professional advice.

“It is a trap to dedicate something rashly and only later to consider one’s vows.”

– Proverbs 20:25